Budget Watch - GENERAL REVENUE ESTIMATES INCREASED BY $2.6 BILLION

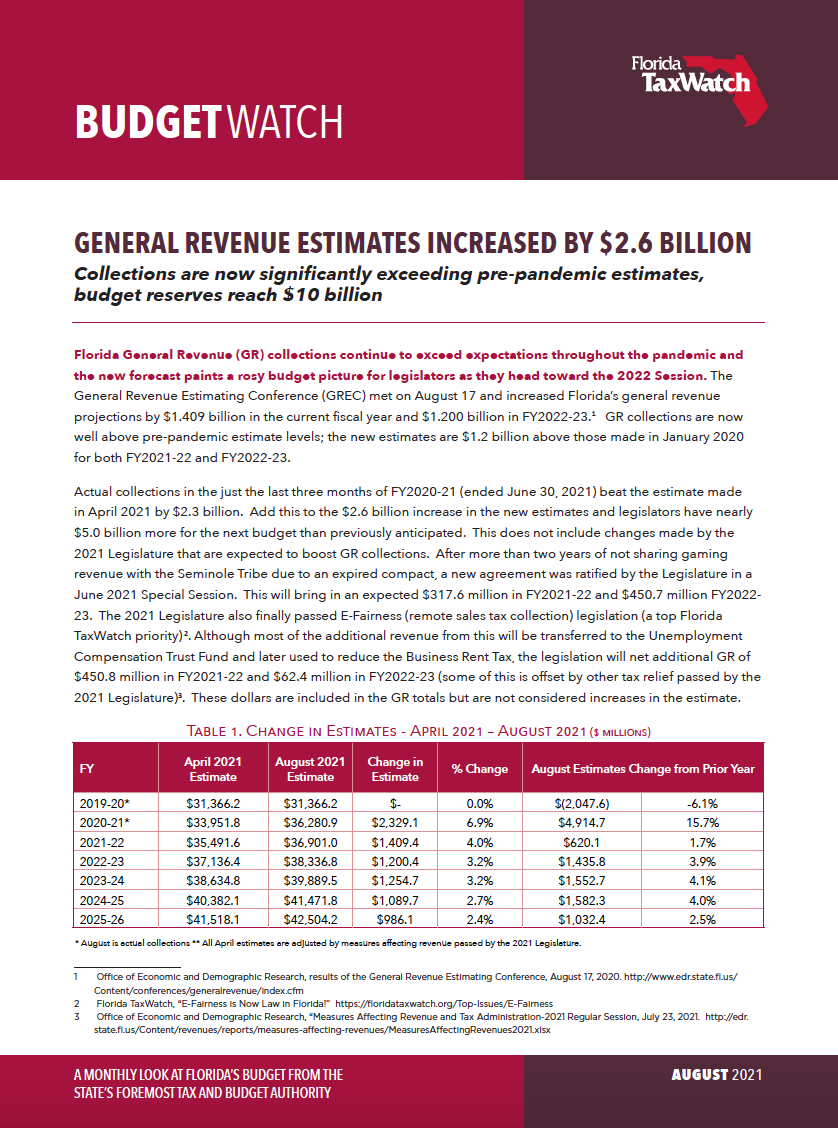

Florida General Revenue (GR) collections continue to exceed expectations throughout the pandemic and the new forecast paints a rosy budget picture for legislators as they head toward the 2022 Session. The General Revenue Estimating Conference (GREC) met on August 17 and increased Florida’s general revenue projections by $1.409 billion in the current fiscal year and $1.200 billion in FY2022-23.1 GR collections are now well above pre-pandemic estimate levels; the new estimates are $1.2 billion above those made in January 2020 for both FY2021-22 and FY2022-23.

Actual collections in the just the last three months of FY2020-21 (ended June 30, 2021) beat the estimate made in April 2021 by $2.3 billion. Add this to the $2.6 billion increase in the new estimates and legislators have nearly $5.0 billion more for the next budget than previously anticipated. This does not include changes made by the 2021 Legislature that are expected to boost GR collections. After more than two years of not sharing gaming revenue with the Seminole Tribe due to an expired compact, a new agreement was ratified by the Legislature in a June 2021 Special Session. This will bring in an expected $317.6 million in FY2021-22 and $450.7 million in FY2022-23. The 2021 Legislature also finally passed E-Fairness (remote sales tax collection) legislation (a top Florida TaxWatch priority) 2. Although most of the additional revenue from this will be transferred to the Unemployment Compensation Trust Fund and later used to reduce the Business Rent Tax, the legislation will net additional GR of $450.8 million in FY2021-22 and $62.4 million in FY2022-23 (some of this is offset by other tax relief passed by the 2021 Legislature)3. These dollars are included in the GR totals but are not considered increases in the estimate.

As usual, the sales tax—by far the largest GR source in Florida—drove the new forecast. The sales tax estimates were increased by $1.367 billion in FY2021- 22 and $668.5 million in FY2022- 23, with all six sales tax categories increasing. The second-largest increase in the forecast is in corporate income taxes (CIT), the second-largest GR source. Due in large part to the increased tax base created by the federal Tax Cuts and Jobs Act and the state’s decision to not adopt provisions in the CARES Act to mitigate some of it, total CIT receipts are skyrocketing, increasing 37.0 percent in FY2020-21 and 20.4 percent in FY2021-22; however, the automatic refunds and tax rate reductions put in place to offset some of this tax increase will be triggered again.

Federal aid has played a big part in keeping the state’s fiscal ship afloat during the pandemic. Now, with Florida’s general revenue sources performing beyond anyone’s expectations, the state’s budget outlook has progressed way past solvent and has become downright rosy. On June 30, Florida’s General Revenue Fund ended FY2020-21 with an unprecedented balance of $13.2 billion (see Table 3).

The COVID-19 crisis is not over. The Delta variant—and other potential mutations--still pose considerable risk to public health and the economy. But Florida’s state government finances have thus far made it through the pandemic in good shape. In fact, the state’s budget outlook is probably in the best it has ever been.