Beyond the Pandemic: Long-Term Changes and Challenges for Florida’s Workforce

In many ways, Florida's workforce looks starkly different from when it first entered the pandemic over a year ago. Challenges with controlling the spread of COVID-19 precipitated the widespread use of remote work and other digital formats across the state. These changes accelerated workforce trends that were present before COVID-19 (such as automation) and now foreshadow a future workforce that will constantly face disruption and displacement. Ultimately, these changes have long-term ramifications for Florida’s future economic growth, talent pipeline, workforce development, and fiscal sustainability.

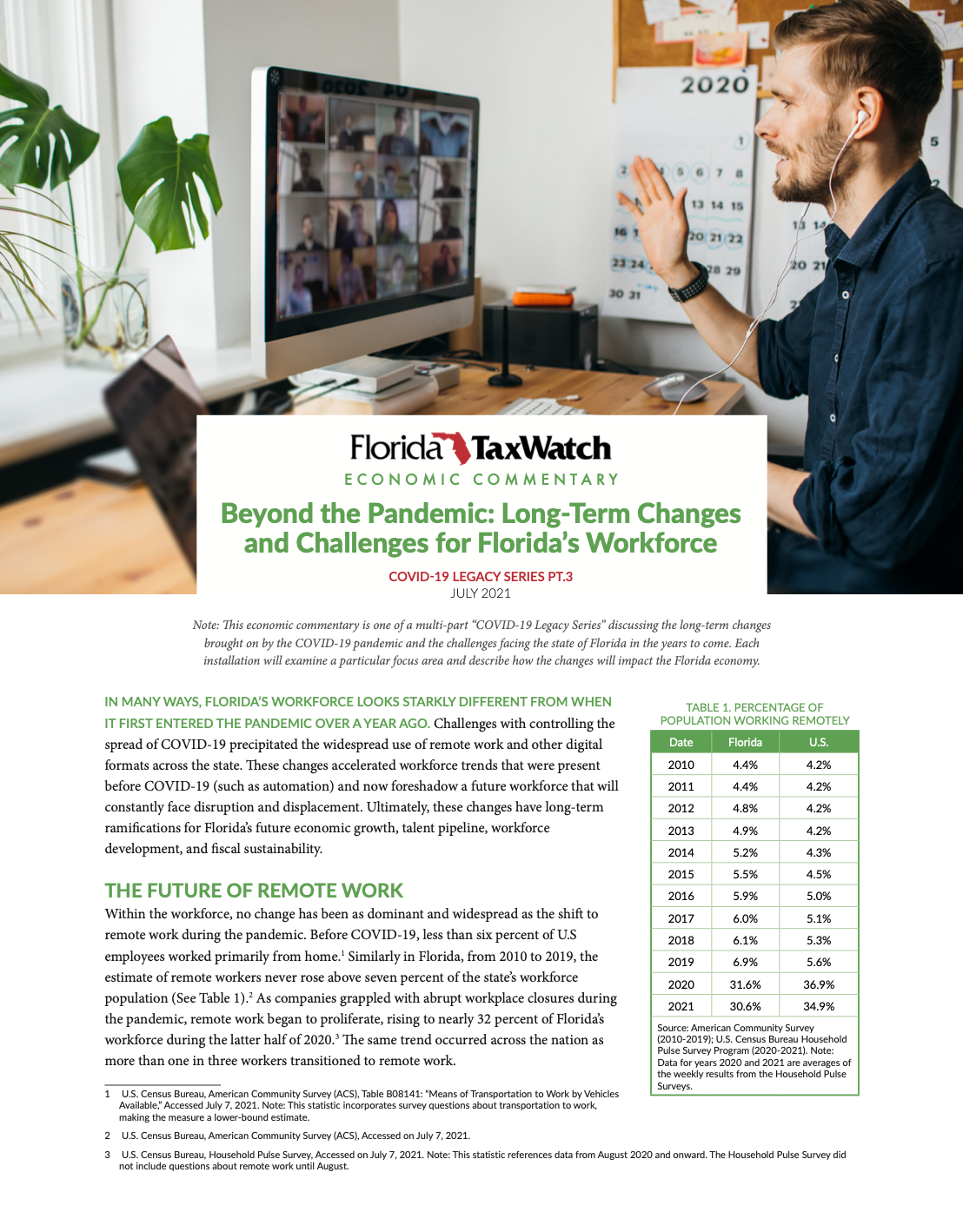

Within the workforce, no change has been as dominant and widespread as the shift to remote work during the pandemic. As companies grappled with abrupt workplace closures during the pandemic, remote work began to proliferate, rising to nearly 32 percent of Florida’s workforce during the latter half of 2020. The same trend occurred across the nation as more than one in three workers transitioned to remote work. Future remote work will have a significant impact on local economic activity.

In addition to remote work, the COVID-19 pandemic has accelerated the adoption of automation and artificial intelligence (AI) among companies in various industries. As companies sought to limit the risk of infection in workplaces and maintain operations, many businesses deployed automation and AI in various contexts: at grocery stores, restaurants, warehouses, hotels, clinics, and more. Across all sectors, and especially within service-oriented industries, automation was a widespread means of survival—rather than a means of competitive advantage—to continue business operations while also dealing with public health risks. Looking ahead, companies will increasingly prioritize capital investment in new technologies to adapt to more frequent future disruptions.

The pandemic has demonstrated that talent does not have to be place-bound (restricted to a particular location). This, in turn, creates a future economic benefit for Florida if it attracts workers to relocate to Florida while working remotely for out-of-state companies. Remote work will also require policymakers and economic developers to rethink the traditional metrics that have typified economic development, namely job creation and capital investment. For Florida’s future fiscal picture, changes in the post-COVID workforce will inevitably affect how much tax revenue state and local governments collect.

Additional factors that remain unknown at the moment, yet require continued research, include the impact of childcare responsibilities, unemployment insurance, and workers’ desires for higher-skilled jobs. Despite the uncertainty around these areas of interest, one thing does remain clear: Florida’s workforce, much like the rest of the world, is undergoing a seismic change that will transform the future of work.