Economic Commentary - The State of Medicaid in Florida

IN PAST ECONOMIC DOWNTURNS, SOCIAL SAFETY NET PROGRAMS HAVE PERFORMED AS LARGE STABILIZERS to support vulnerable populations during times of financial distress. Yet as the past year has shown, the COVID-19 pandemic has placed an unprecedented strain on the country’s safety net system. In particular, Medicaid—which provides health insurance to low-income families, children, and disabled individuals—has faced difficulty accommodating the growing wave of enrollments. Even as the economic recovery begins to take form in Florida, the challenges confronting the state’s Medicaid system will remain a forefront issue. For this reason, it is important to understand how Florida’s Medicaid program has fared during the public health emergency and what economic challenges lie ahead as the state goes forward in recovery.

COVID-19 AND MEDICAID’S SURGING ENROLLMENT

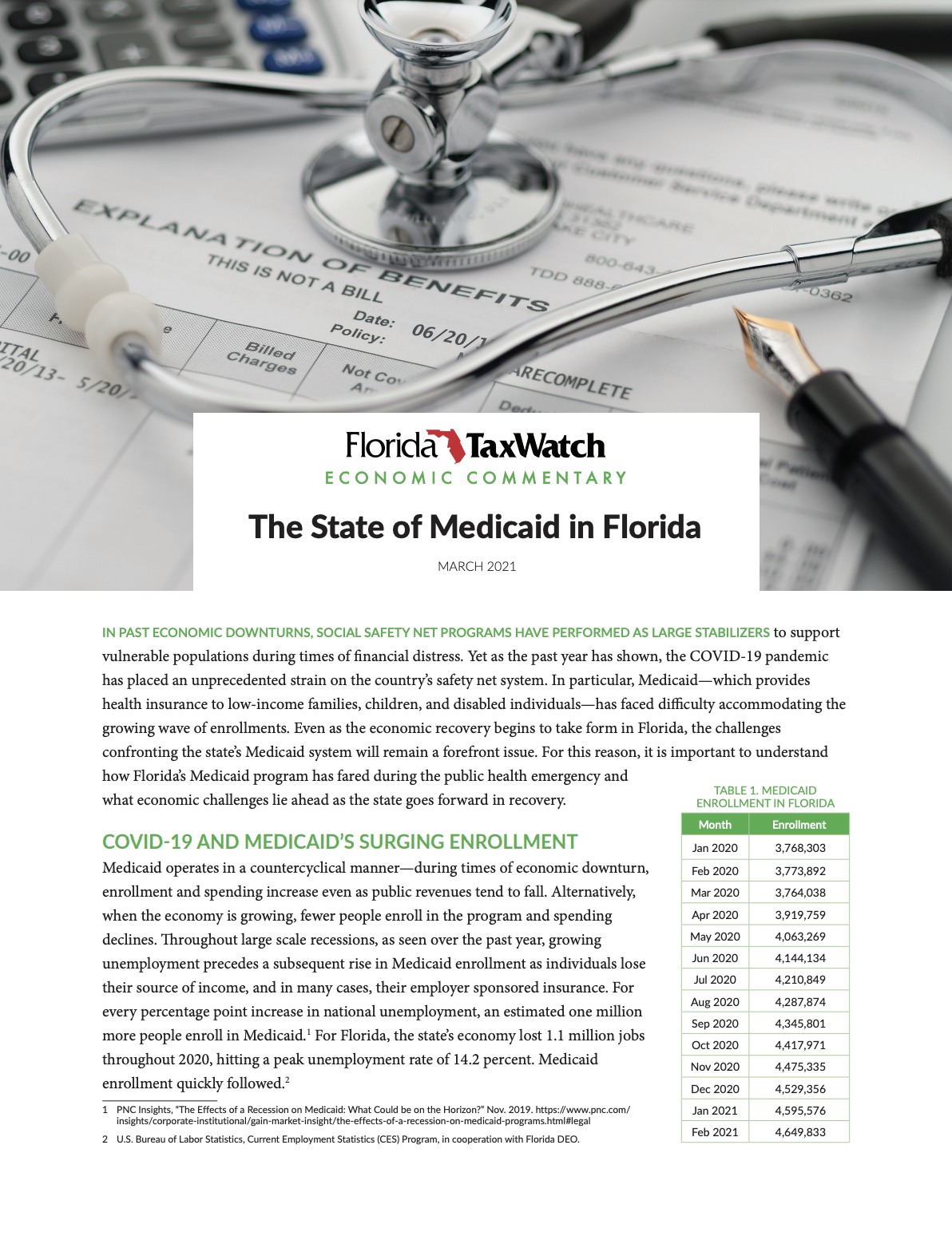

Medicaid operates in a countercyclical manner—during times of economic downturn, enrollment and spending increase even as public revenues tend to fall. Alternatively, when the economy is growing, fewer people enroll in the program and spending declines. Throughout large scale recessions, as seen over the past year, growing unemployment precedes a subsequent rise in Medicaid enrollment as individuals lose their source of income, and in many cases, their employer sponsored insurance. For every percentage point increase in national unemployment, an estimated one million more people enroll in Medicaid. For Florida, the state’s economy lost 1.1 million jobs throughout 2020, hitting a peak unemployment rate of 14.2 percent. Medicaid enrollment quickly followed.

Since the start of the COVID-19 pandemic in March 2020, Medicaid enrollment in Florida has risen by 885,000, or about 23.5 percent. As of February 2021 (latest data available), enrollment stood at 4.6 million. According to the Office of Economic and Demographic Research (EDR), Medicaid enrollment is expected to continue climbing in the year ahead, eventually leveling off in 2022 due to a gradual labor market recovery as workers reclaim more jobs. Yet at the moment, enrollment appears to be steadily increasing.