Every Child a Swimmer

Watch the full press conference here.

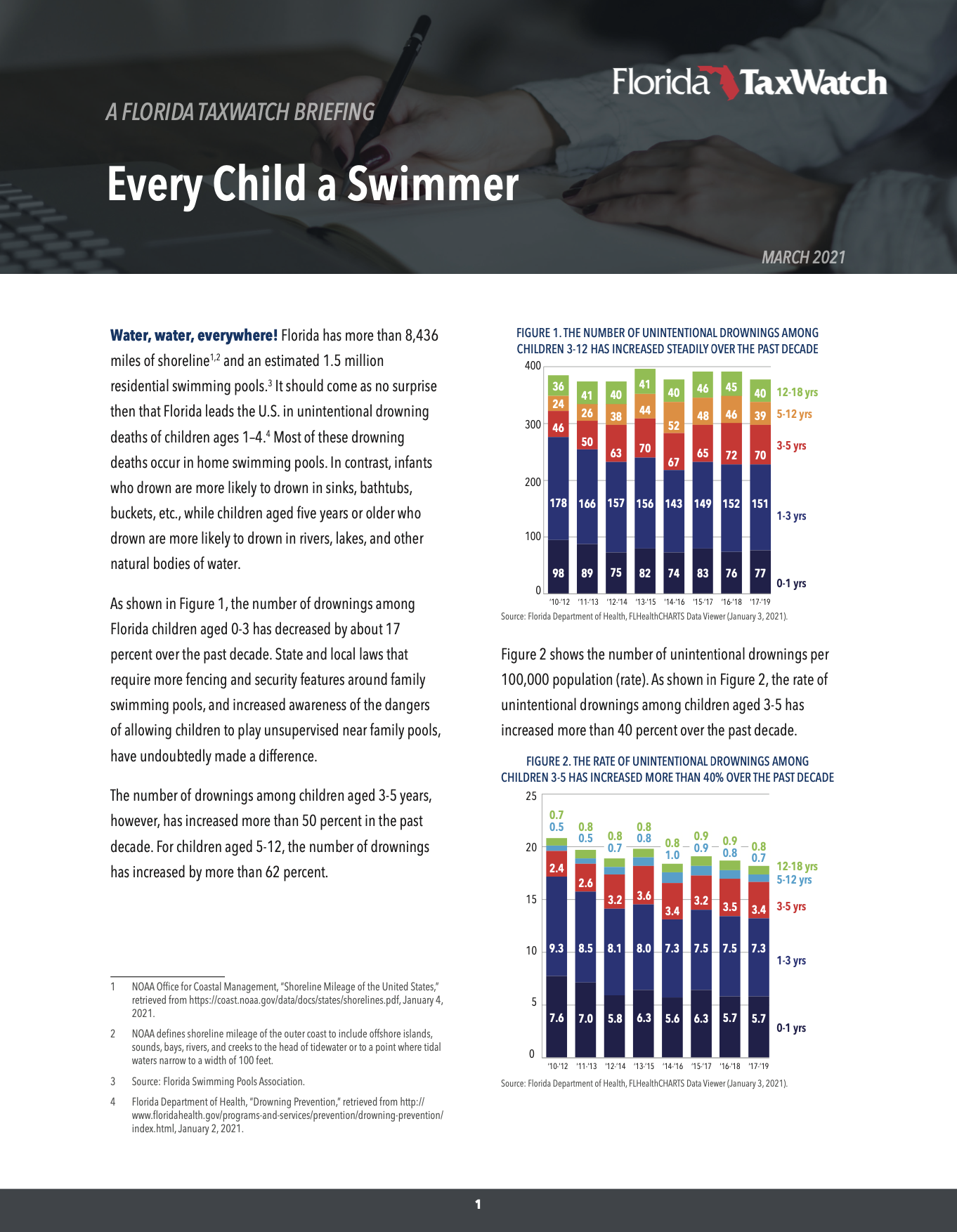

Water, water, everywhere! Florida has more than 8,436 miles of shoreline and an estimated 1.5 million residential swimming pools. It should come as no surprise then that Florida leads the U.S. in unintentional drowning deaths of children ages 1–4. Most of these drowning deaths occur in home swimming pools. In contrast, infants who drown are more likely to drown in sinks, bathtubs, buckets, etc., while children aged five years or older who drown are more likely to drown in rivers, lakes, and other natural bodies of water.

The real tragedy lies in the fact that most of these childhood drownings could be prevented by making sure everyone in the family knows how to swim. In furtherance of this, Senator Lori Berman has filed Senate Bill (SB) 358 which, if enacted into law, would require each child who is entitled to admittance to kindergarten, or who is entitled to any other initial entrance into a public or private school in Florida, to present a certificate showing they had successfully completed a nationally recognized water safety education course and nationally recognized age-appropriate swimming lessons within one year prior to enrollment in school. It is important to note that a child may be exempted from the certification requirement if the child’s parent submits a written objection, based on any grounds, to the school in which the child is enrolled or into which the child is entering.

Florida TaxWatch believes it is essential that children are taught how to swim at an early age. Swimming is perhaps the only sport or physical activity that will save a life, so making sure children are comfortable in and around the water is paramount to their safety. Swimming also helps to build endurance, muscle strength and cardiovascular fitness. Like other forms of exercise, swimming has been linked to improved mental health by reducing stress, anxiety, and depression.13 Florida TaxWatch commends Senator Berman and Representatives Daley and Mooney for their efforts to prevent unintentional childhood drownings.