BudgetWatch: New General Revenue Estimates Add $7 Billion for the Next Budget

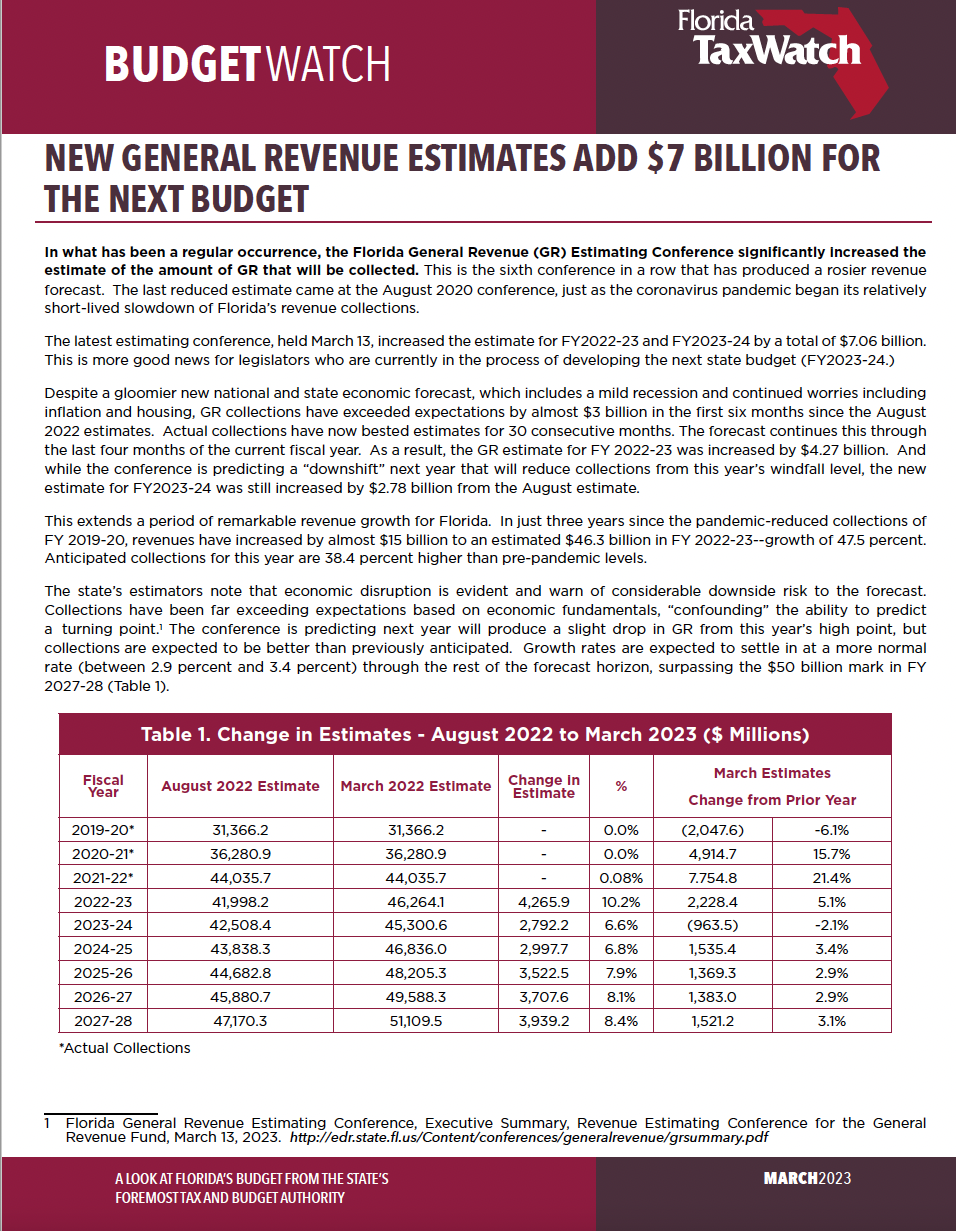

The latest estimating conference, held March 13, increased the estimate for FY2022-23 and FY2023-24 by a total of $7.06 billion. This is more good news for legislators who are currently in the process of developing the next state budget (FY2023-24.) Despite a gloomier new national and state economic forecast, which includes a mild recession and continued worries includinginflation and housing, GR collections have exceeded expectations by almost $3 billion in the first six months since the August 2022 estimates. Actual collections have now bested estimates for 30 consecutive months. The forecast continues this through the last four months of the current fiscal year. As a result, the GR estimate for FY 2022-23 was increased by $4.27 billion. And while the conference is predicting a “downshift” next year that will reduce collections from this year’s windfall level, the new estimate for FY2023-24 was still increased by $2.78 billion from the August estimate. This extends a period of remarkable revenue growth for Florida. In just three years since the pandemic-reduced collections of FY 2019-20, revenues have increased by almost $15 billion to an estimated $46.3 billion in FY 2022-23--growth of 47.5 percent. Anticipated collections for this year are 38.4 percent higher than pre-pandemic levels.

The latest estimating conference, held March 13, increased the estimate for FY2022-23 and FY2023-24 by a total of $7.06 billion. This is more good news for legislators who are currently in the process of developing the next state budget (FY2023-24.) Despite a gloomier new national and state economic forecast, which includes a mild recession and continued worries includinginflation and housing, GR collections have exceeded expectations by almost $3 billion in the first six months since the August 2022 estimates. Actual collections have now bested estimates for 30 consecutive months. The forecast continues this through the last four months of the current fiscal year. As a result, the GR estimate for FY 2022-23 was increased by $4.27 billion. And while the conference is predicting a “downshift” next year that will reduce collections from this year’s windfall level, the new estimate for FY2023-24 was still increased by $2.78 billion from the August estimate. This extends a period of remarkable revenue growth for Florida. In just three years since the pandemic-reduced collections of FY 2019-20, revenues have increased by almost $15 billion to an estimated $46.3 billion in FY 2022-23--growth of 47.5 percent. Anticipated collections for this year are 38.4 percent higher than pre-pandemic levels.

Florida’s hardworking taxpayers have numerous challenges impacting their pocketbooks--inflation, housing costs, and skyrocketing insurance premiums. Florida TaxWatch will continue to monitor and analyze budget developments and ensure that taxpayers best interests are being served. We will continue to work closely with elected officials to ensure that some of these tax dollars are returned to those that paid them, help avoid wasteful spending, and improve the process for selecting member projects.