THE GREAT IMBALANCE: INFLATION’S INFLUENCE IN THE COVID-19 ECONOMY

INFLATION IS HARDLY A NEW PHENOMENON EXCLUSIVE TO THE COVID-19 PANDEMIC; however, for decades preceding the pandemic, price increases were a subtle and often unnoticed component of the economy. The last time inflation posed a serious and prolonged threat to economic growth—in the early 1980s—Ronald Reagan was the president, the Iranian Hostage Crisis had ended, and Indiana Jones: Raiders of the Lost Ark made its theater debut. The early 1980s signified the end of what economists called “The Great Inflation” period in U.S. history.

Snapshot:

- The CPI ( Consumer Price Index) soared 7.0% higher in December 2021 compared to a year earlier.

- Excluding the more volatile food and energy components, core CPI rose by 5.5%.

- In Florida, Tampa has the highest CPI increase at 8%, which surpasses both the southern U.S. and national averages.

- The PPI (Producer Price Index) increased by 9.7% compared to December 2021. For Florida restaurants and manufacturers, for example, these higher prices for necessary inputs present a tough decision between absorbing costs (thereby lowering potential profits) or raising prices.

- According to the U.S. Bureau of Labor Statistics (BLS), the purchasing power of the U.S. dollar has decreased 6.5% in December 2021 compared to the year prior.

- Price increases have been lasting longer than expected as acknowledged by the Federal Reserve.

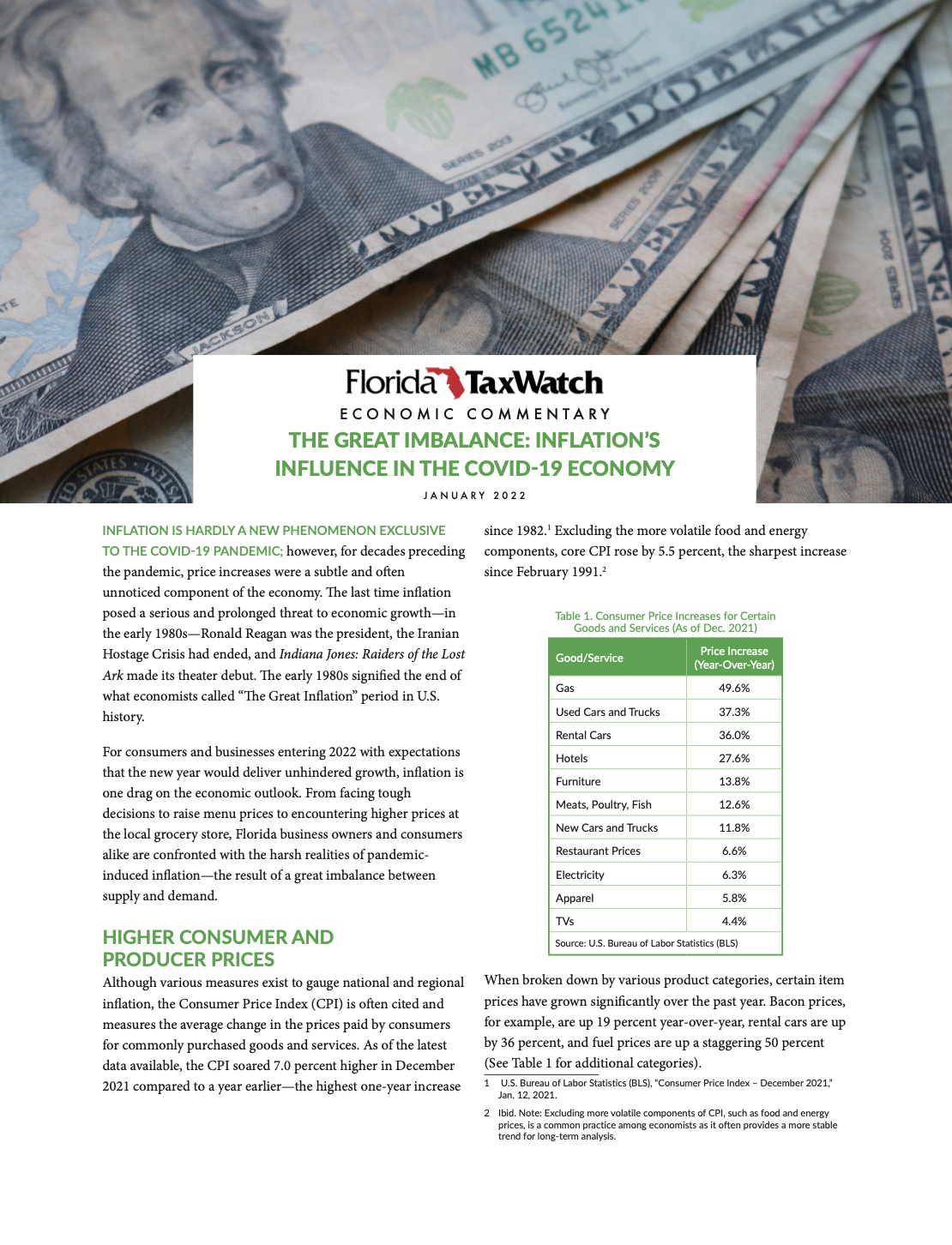

The Consumer Price Index (CPI) is often cited and measures the average change in the prices paid by consumers for commonly purchased goods and services. As of the latest data available, the CPI soared 7.0 percent higher in December 2021 compared to a year earlier—the highest one-year increase since 1982. Excluding the more volatile food and energy components, core CPI rose by 5.5 percent, the sharpest increase since February 1991. When broken down by various product categories, certain item prices have grown significantly over the past year. Bacon prices, for example, are up 19 percent year-over-year, rental cars are up by 36 percent, and fuel prices are up a staggering 50 percent. Inflation is also exhibiting regional variation throughout the state of Florida. By major cities, Tampa leads the list with the highest year-over-year price increase at 8.0 percent. Not only does this lead other major cities such as Orlando, Jacksonville, and Miami, but it also surpasses both the southern U.S. and national averages.

Headlines about consumer prices often garner most of the attention for their resonance with everyday customers; however, just as consequential are price increases for producers ranging from local manufacturers to multi-state businesses. The Producer Price Index (PPI) looks at price changes from the seller’s perspective, reflecting the production costs for various goods and services. According to the most recent PPI release, producer prices increased by 9.7 percent over the year in December 2021—the largest advance since 2010 and higher than the CPI. For Florida restaurants and manufacturers, for example, these higher prices for necessary inputs present a tough decision between absorbing costs (thereby lowering potential profits) or raising prices.

The economic forces at work over the past two years have created a persistent imbalance and triggered the notable rise in inflation witnessed today. At this point in the recovery, too much remains unknown about which specific factors are contributing most to inflation and how long they will last. Nevertheless, at a minimum, inflation is the natural cost of coming out of a severe downturn.

With national data suggesting inflation is running hot in the U.S., the trends also have important implications for Florida’s economy, government, and taxpayers. Higher prices for everyday goods and services result in lower purchasing power for many Floridians. According to the U.S. Bureau of Labor Statistics (BLS), the purchasing power of the U.S. dollar has decreased 6.5 percent in December 2021 compared to the year prior—the largest one-year decrease since 1982. For Florida families residing in low-income and rural areas, these impacts further constrain budgets. Income growth is typically less pronounced in these areas, making it more difficult to adapt to rising prices for essentials like groceries, energy, and gas.

Inflation is proving to be anything but “transitory,” as evidenced by comments from the Federal Reserve acknowledging price increases have been lasting longer than expected. Yet even with inflation reports signaling higher prices on the immediate horizon, there is hope that 2022 will see inflation begin to taper down.

Will consumers begin to expect future inflation to become more permanent and shift consumption behaviors/wage demands as a result? The Omicron variant and future variants will also play a large, albeit unknown, role in affecting consumer decisions. For all these reasons—both known and unknown—inflation must be watched closely as policy discussions and debates continue to unfold.