The Backbone of the Economy: How Small Businesses in Florida Have Fared During the Pandemic

Small businesses are major drivers in the U.S. economy, spurring local job creation and innovation while also fostering entrepreneurship among women, minorities, veterans, and other portions of the population. Nationally, small businesses account for 48 percent of all American jobs and contribute 43.5 percent of U.S. Gross Domestic Product (GDP). Even though these businesses are considered the “backbone of the economy,” small businesses have faced an economic and existential crisis during the COVID-19 pandemic.

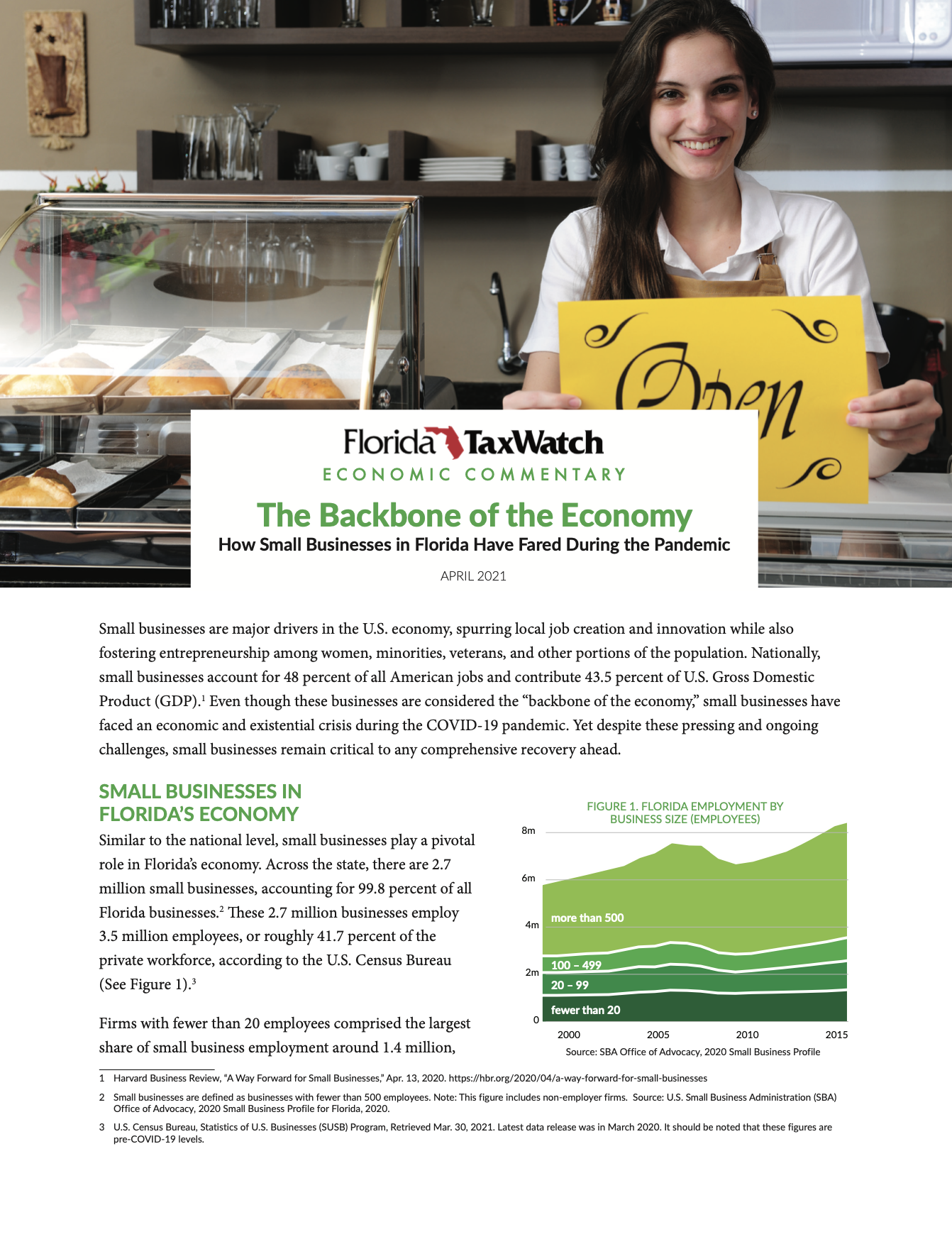

Similar to the national level, small businesses play a pivotal role in Florida’s economy. Across the state, there are 2.7 million small businesses, accounting for 99.8 percent of all Florida businesses. Based on data from Harvard University’s Economic Tracker, the number of small businesses open in Florida (compared to January 2020 before the pandemic) reached a low of -44.2 percent in April 2020 and since then has remained relatively stagnate around -32.0 percent since 2021 started. Paralleling the drop in small business openings, the drop in small business revenue has also been relegated below pre-pandemic levels. As of March 31, 2021, small business revenue in Florida was -31.0 percent relative to the beginning of 2020.

The situation becomes even more grave when looking at Florida’s hardest-hit economic sectors and when considering lending became more constricted as small businesses faced declining cash flow from falling consumer demand. The federal government’s Paycheck Protection Program (PPP) offered a lifeline in response. So far, Florida has received roughly 579,000 PPP loans, totaling an estimated $41 billion in aid.

Regardless of the challenges that small businesses presently face, they remain crucial to Florida’s long-term economic recovery. Before COVID-19, small businesses were responsible for 133,000 net new jobs in Florida, and of the state’s net new jobs since 2012, more than 81.4 percent come from small businesses with fewer than 500 employees. A few common threads run through the difficulties small businesses will continue to experience. First, of all the potential solution to mitigate risk and adapt, a lack of capital and financial resources will confine most businesses. Targeted federal assistance as seen through PPP loans is a necessary lifeline; however, these policies ultimately postpone, not eliminate, financial pressures. Furthermore, most small businesses will continue to endure slim operating margins as cash inflow will depend on consumer confidence. For Florida, since most small businesses are directly or indirectly related to the Leisure and Hospitality industry, they may continue to lag behind broader U.S. recovery efforts until a general uptick in tourism resumes. For policymakers and local leaders, understanding how policy changes may inordinately impact small businesses will be an important consideration for future discussions and decisions surrounding economic growth and development.