Labor Market Data Indicates a Cool-Down: Could Florida's Workforce Experience a Cold Summer?

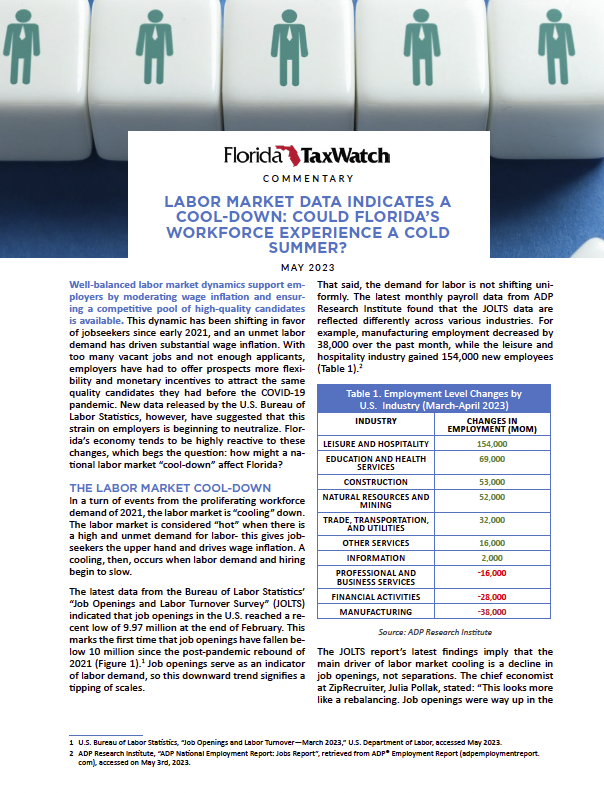

This dynamic has been shifting in favor of jobseekers since early 2021, and an unmet labor demand has driven substantial wage inflation. With too many vacant jobs and not enough applicants, employers have had to offer prospects more flexibility and monetary incentives to attract the same quality candidates they had before the COVID-19 pandemic. New data released by the U.S. Bureau of Labor Statistics, however, has suggested that this strain on employers is beginning to neutralize. Florida’s economy tends to be highly reactive to these changes, which begs the question: how might a national labor market “cooldown” affect Florida?

This dynamic has been shifting in favor of jobseekers since early 2021, and an unmet labor demand has driven substantial wage inflation. With too many vacant jobs and not enough applicants, employers have had to offer prospects more flexibility and monetary incentives to attract the same quality candidates they had before the COVID-19 pandemic. New data released by the U.S. Bureau of Labor Statistics, however, has suggested that this strain on employers is beginning to neutralize. Florida’s economy tends to be highly reactive to these changes, which begs the question: how might a national labor market “cooldown” affect Florida?

Current labor market conditions in Florida do not signal a “cooling” just yet, but a return to typical workforce dynamics may be on the horizon if the demand for workers continues to ease across industries. Notably high migration, job growth, and GDP growth prompt a positive outlook for the state economy, but employers in some of Florida’s major industries are struggling to accumulate a workforce to support this growth after labor force participation slumped during the pandemic. The prominent retired and elderly population of Florida poses questions of capacity for the state’s workforce to meet the demands of its flourishing businesses. No matter what changes occur in the labor market, it is crucial to note that Florida is pro cyclical and highly responsive to economic shifts. That is, when changes occur at the national level, these changes are amplified in Florida. If a shift in bargaining power is occurring nationwide, it is possible that jobseekersm in Florida could find themselves with even less leverage. As the tables begin to turn nationally, employers and workers should keep a thermometer on Florida’s labor market dynamics keeping this in mind.