The Economic and Fiscal Significance of the U.S. Census and American Community Survey

What if the very data used to drive customer and market intelligence, justify business decisions, or construct new physical infrastructure were in jeopardy? Even more consequential, what if the at-risk data guided the distribution of more than $1.5 trillion every year?

What if the very data used to drive customer and market intelligence, justify business decisions, or construct new physical infrastructure were in jeopardy? Even more consequential, what if the at-risk data guided the distribution of more than $1.5 trillion every year?

Often overlooked, the data supplied by the U.S. Census Bureau do more than just provide a snapshot of the population size every ten years. The data power the economy, guiding decision-making processes for businesses and policymakers alike and creating insights about the country’s direction. Due to the COVID-19 pandemic, funding, and other issues, there is now a profound danger to the nation’s data foundation.

The once-in-a-lifetime pandemic disrupted the 2020 Census— the 24th in U.S. history—delaying field operations and hampering the public’s ability to respond. Even though much attention was on the decennial Census, the pandemic also hindered data collection efforts for another essential source of data: the American Community Survey (ACS). The ACS is a continuous nationwide survey that provides critical and timely economic, social, housing, and demographic data every year, but operational challenges involving the 3.5 million households surveyed annually called into question the reliability of the data for 2020.

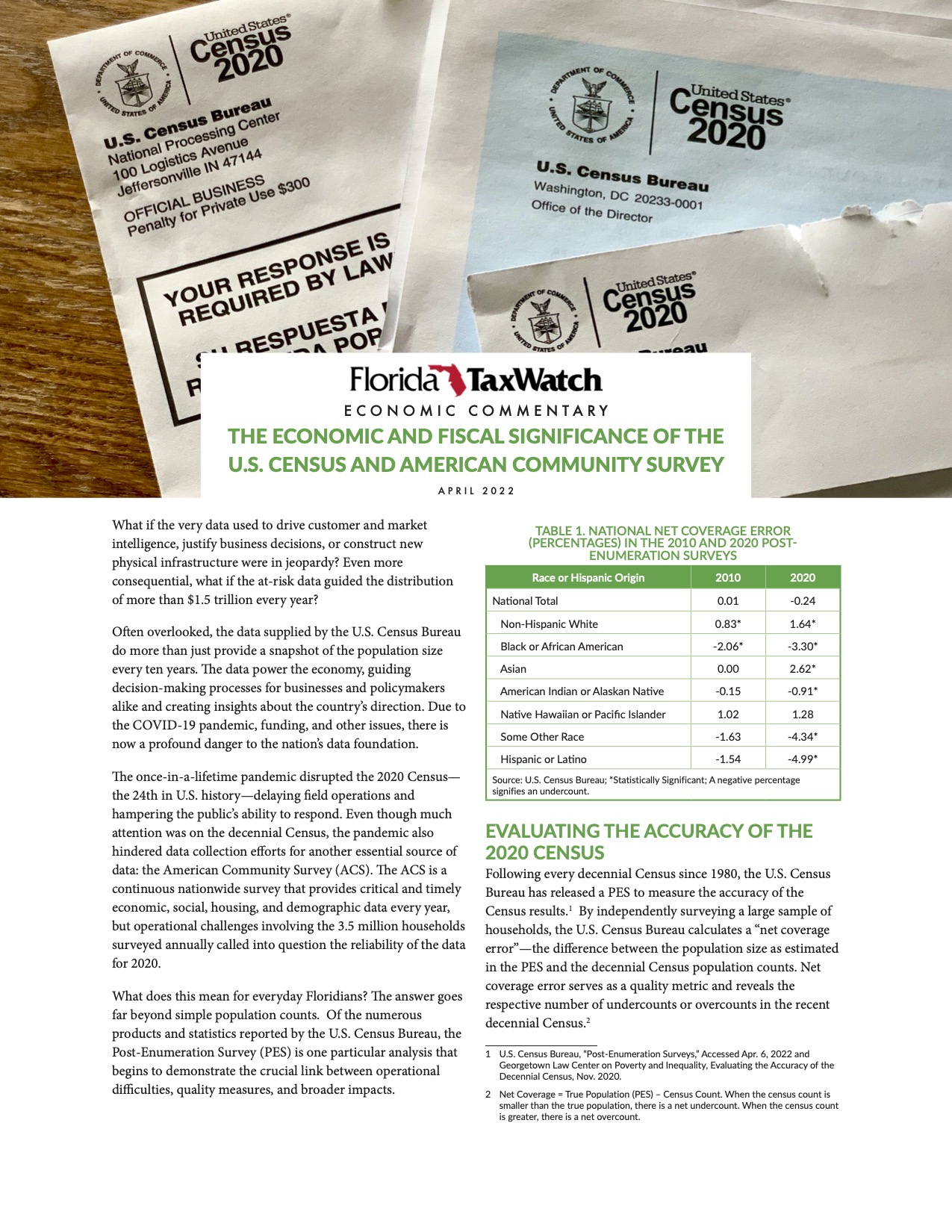

What does this mean for everyday Floridians? The answer goes far beyond simple population counts. Of the numerous products and statistics reported by the U.S. Census Bureau, the Post-Enumeration Survey (PES) is one particular analysis that begins to demonstrate the crucial link between operational difficulties, quality measures, and broader impacts.

Following every decennial Census since 1980, the U.S. Census Bureau has released a PES to measure the accuracy of the Census results. By independently surveying a large sample of households, the U.S. Census Bureau calculates a “net coverage error”—the difference between the population size as estimated in the PES and the decennial Census population counts. Net coverage error serves as a quality metric and reveals the respective number of undercounts or overcounts in the recent decennial Census.