IDEAS IN ACTION: Florida’s Insurance Crisis—Brought by Lawyers

Guest Column By Josiah Neeley

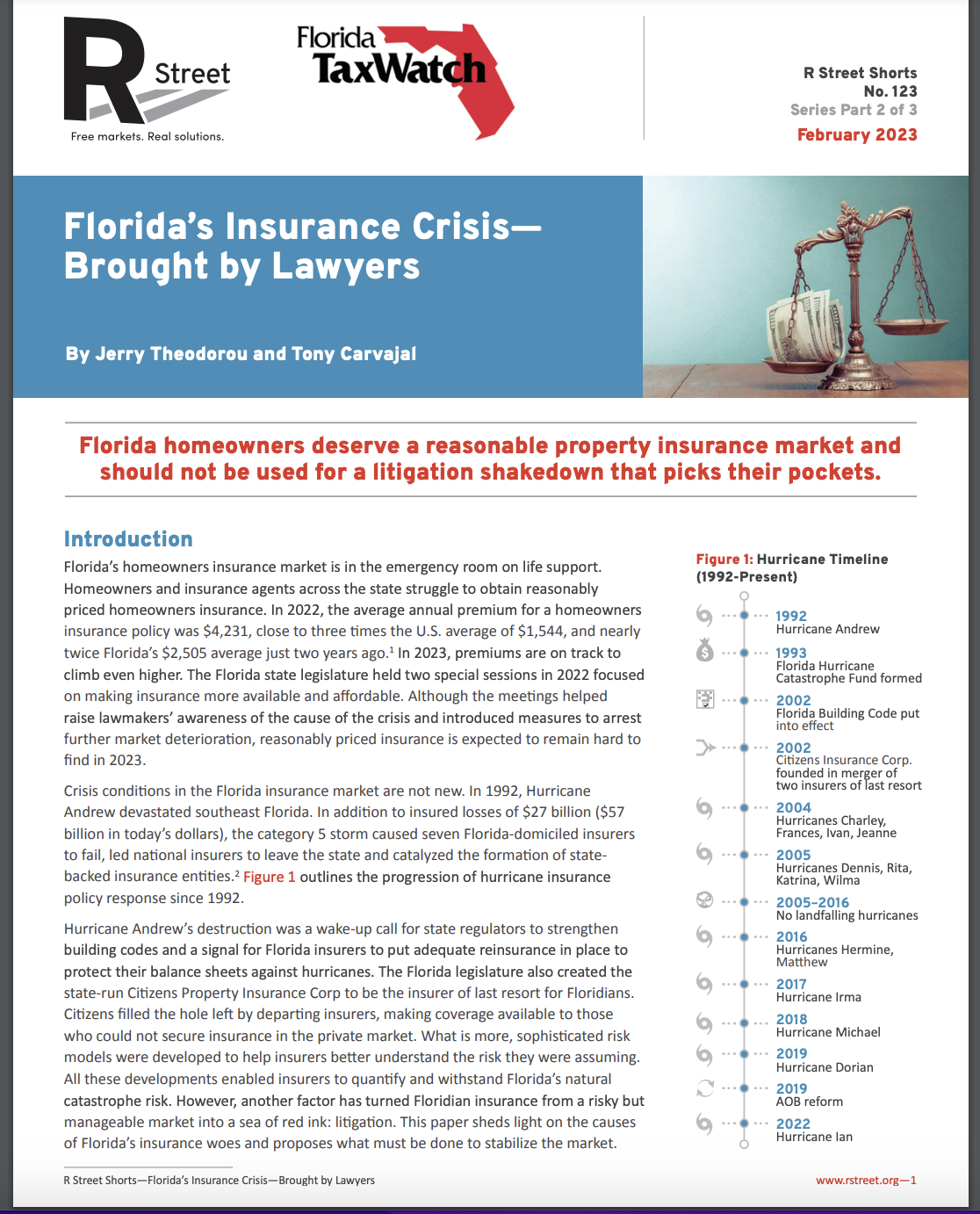

Crisis conditions in the Florida insurance market are not new. In 1992, Hurricane Andrew devastated southeast Florida. In addition to insured losses of $27 billion ($57 billion in today’s dollars), the category 5 storm caused seven Florida-domiciled insurers to fail, led national insurers to leave the state and catalyzed the formation of statebacked insurance entities.2 Figure 1 outlines the progression of hurricane insurance policy response since 1992. Hurricane Andrew’s destruction was a wake-up call for state regulators to strengthen building codes and a signal for Florida insurers to put adequate reinsurance in place to protect their balance sheets against hurricanes. The Florida legislature also created the state-run Citizens Property Insurance Corp to be the insurer of last resort for Floridians. Citizens filled the hole left by departing insurers, making coverage available to those who could not secure insurance in the private market. What is more, sophisticated risk models were developed to help insurers better understand the risk they were assuming. All these developments enabled insurers to quantify and withstand Florida’s natural catastrophe risk. However, another factor has turned Floridian insurance from a risky but manageable market into a sea of red ink: litigation. This paper sheds light on the causes of Florida’s insurance woes and proposes what must be done to stabilize the market.

Crisis conditions in the Florida insurance market are not new. In 1992, Hurricane Andrew devastated southeast Florida. In addition to insured losses of $27 billion ($57 billion in today’s dollars), the category 5 storm caused seven Florida-domiciled insurers to fail, led national insurers to leave the state and catalyzed the formation of statebacked insurance entities.2 Figure 1 outlines the progression of hurricane insurance policy response since 1992. Hurricane Andrew’s destruction was a wake-up call for state regulators to strengthen building codes and a signal for Florida insurers to put adequate reinsurance in place to protect their balance sheets against hurricanes. The Florida legislature also created the state-run Citizens Property Insurance Corp to be the insurer of last resort for Floridians. Citizens filled the hole left by departing insurers, making coverage available to those who could not secure insurance in the private market. What is more, sophisticated risk models were developed to help insurers better understand the risk they were assuming. All these developments enabled insurers to quantify and withstand Florida’s natural catastrophe risk. However, another factor has turned Floridian insurance from a risky but manageable market into a sea of red ink: litigation. This paper sheds light on the causes of Florida’s insurance woes and proposes what must be done to stabilize the market.