How Childcare Impacts the State’s Economy and Shapes Florida’s Workforce

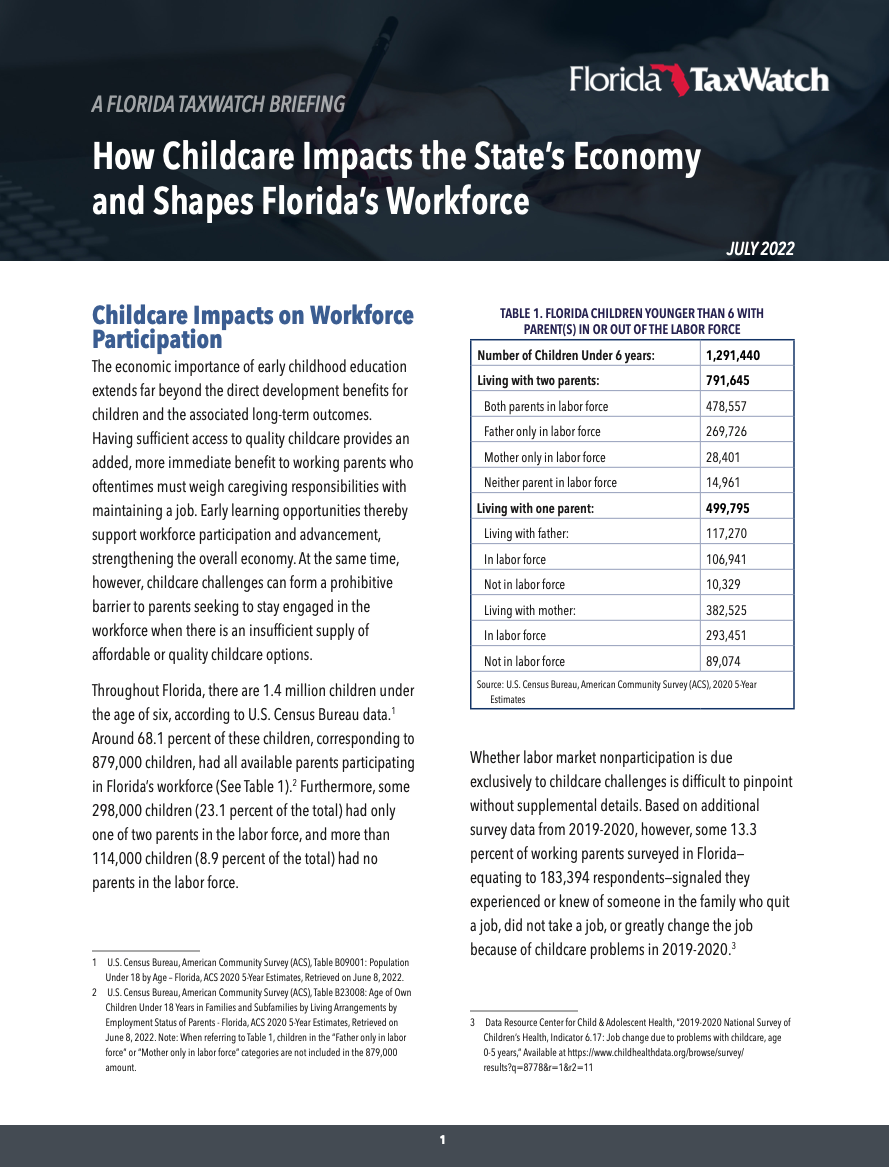

The economic importance of early childhood education extends far beyond the direct development benefits for children and the associated long-term outcomes. Having sufficient access to quality childcare provides an added, more immediate benefit to working parents who often must weigh caregiving responsibilities with maintaining a job. Early learning opportunities thereby support workforce participation and advancement, strengthening the overall economy. At the same time, however, childcare challenges can form a prohibitive barrier to parents seeking to stay engaged in the workforce when there is an insufficient supply of affordable or quality childcare options.

Statewide Economic Impact in Florida:

- Across four state studies, an average of 46.6 percent of working parents reported absenteeism. Assuming 630,475 working parents (46.6 percent of Florida’s workforce with young children) missed an average of 12 days a year, this would create an economic cost of $1,512,422,229 per year.

- In Florida, an estimated 107,390 working parents (8.1 percent of Florida’s workforce with young children) experience an aggregate income loss of $5,696,139,697 annually due to child-care-related turnover. For employers, the turnover costs for replacing workers equate to $1,196,189,336.

- Reductions in potential income, business output, and productivity have added impacts on tax revenue. The loss of earnings mentioned in the previous paragraph—$5,696,139,697—translates into a loss of tax revenue estimated to be $518,348,712.

As the COVID-19 pandemic upended daily life and the economy in 2020, disruptions to employment, schooling, and childcare had enormous implications for working parents, especially for those with young children. As a result, many parents altered their work arrangements or left the labor force altogether to care for their children at home. On a national level, fathers and mothers of young children left the labor force at significant rates in April 2020—3.4 and 2.9 percentage point declines respectively when compared to late 2019 before the pandemic.

When considering the course of labor force participation in Florida throughout the pandemic, a similar trend appears for prime working-aged parents (25-54 years old) with young children. The labor force participation rate (LFPR) for parents with children ages 5 and under dropped 9.7 percentage points between March and April of 2020 as the pandemic spread. For parents with young children, labor force participation has remained below pre-pandemic levels and, as of the first quarter in 2022, the LFPR averaged 78.1 percent, nearly 2.3 percentage points lower than the first quarter in 2020.

Even though lackluster participation rates persisted among parents with young children, significant differences emerged when differentiating between mothers and fathers. Declines in participation were most pronounced among mothers of young children. In Florida, among prime working-aged mothers with young children, the LFPR fell by 11.2 percentage points between March and April 2020, outpacing the decline among fathers, who experienced a decline of 8.5 percentage points.

Although labor market nonparticipation represents the most pronounced cost for families and the economy, not all parents who experienced childcare difficulties dropped out of the workforce. A sizable portion of Florida parents remain employed but cut back hours or took paid/unpaid leave, suggesting a mix of turnover and absences riddled the economic recovery. The subsequent reduction in output and productivity has a compounding cost on local businesses, which must contend with labor supply bottlenecks and worker shortages.

Financial disruptions for individual families cascade throughout the economy, creating a multiplier effect on industries across the community. Although the present analysis does not incorporate multiplier estimates, these effects could be reasonably assumed to increase the cost to Florida’s economy. Future analyses should seek to account for these additional factors while also exploring differences between full-time/part-time status, regions, and industries of employment.