HOUSE AND SENATE BUDGET PROPOSALS ARE $3.3 BILLION APART

There are Plenty of Issues to Negotiate

The House and Senate have passed their respective budgets and now must hold budget conference meetings to hammer out the differences. An agreement must be reached on every number and every word in the 400-plus page appropriations bill. Budget negotiations are never easy and this year will be no exception, even with so much money available. There is more than enough to haggle over, including big potential sticking points in education, health care, the environment, and public safety, not to mention an unprecedented number of local member projects.

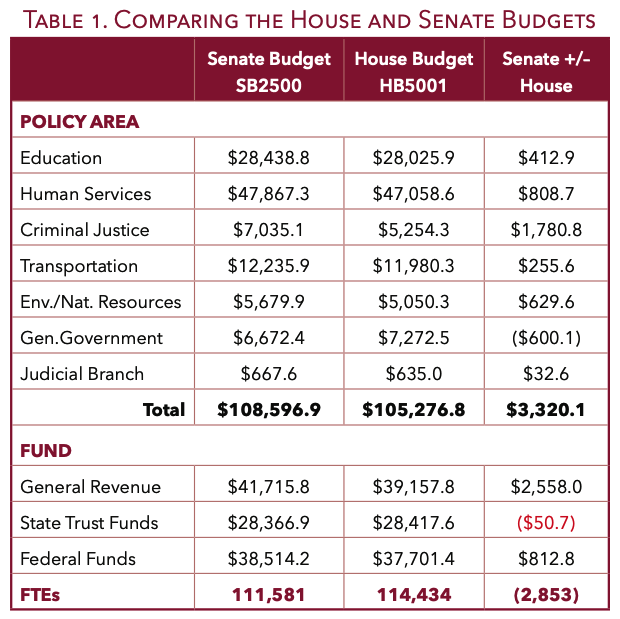

The Senate budget has a bottom line of $108.6 billion and the House spending plan carries a $105.3 billion price tag. These budgets represent increases of 6.8 percent and 3.6 percent, respectively, over current spending of $101.7 billion. Because there are fewer new federal dollars available, more of the budget is made up of general revenue than last year—14.4 percent more in the Senate and 7.4 percent more in the House.

BESIDES THE $3.3 BILLION GULF BETWEEN THE BOTTOM LINES, HOW DO THE HOUSE AND SENATE BUDGETS DIFFER?

This Budget Watch looks at how the House and Senate are proposing to deal with this historic amount of available revenue at their disposal. It highlights the most significant differences between the two plans that will need to be resolved in the budget conference process.