The Taxpayer's Guide to Florida's FY2023-24 State Budget

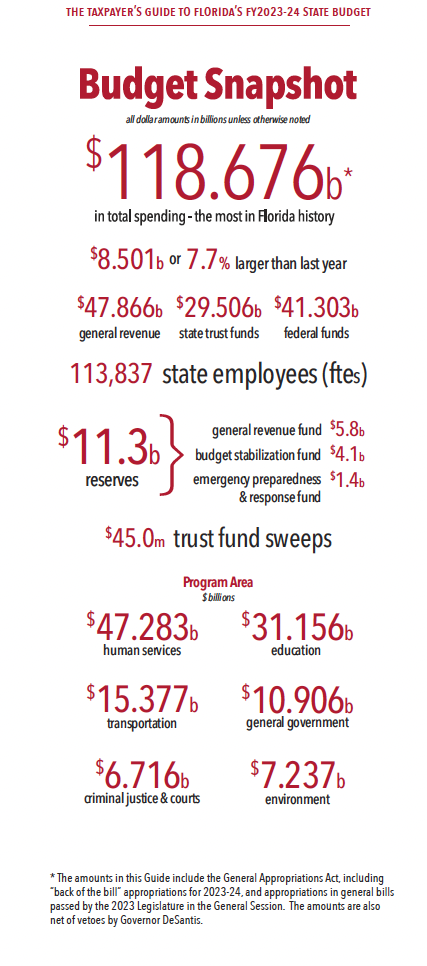

This Budget Guide highlights the fact that the $117.0 billion total for the GAA is not the only spending the Legislature did this session. There were also significant appropriations made in general bills. This happens every session, but the 2023 session stands out, as 28 bills appropriated another $1.5 billion, most of it from General Revenue (GR). This includes $711 million in a landmark affordable housing bill. When that spending, along with almost $0.7 billion in FY2023-24 appropriations made in the “back-of-the-bill” is included, the total appropriated by the 2023 Legislature grows to $118.7 billion (after subtracting $0.5 billion vetoed by the Governor).

This Budget Guide highlights the fact that the $117.0 billion total for the GAA is not the only spending the Legislature did this session. There were also significant appropriations made in general bills. This happens every session, but the 2023 session stands out, as 28 bills appropriated another $1.5 billion, most of it from General Revenue (GR). This includes $711 million in a landmark affordable housing bill. When that spending, along with almost $0.7 billion in FY2023-24 appropriations made in the “back-of-the-bill” is included, the total appropriated by the 2023 Legislature grows to $118.7 billion (after subtracting $0.5 billion vetoed by the Governor).

It is also common for the Legislature to use the GAA to appropriate funds for the current, not the upcoming, fiscal year. This year, the amount of money appropriated for FY2022-23 by this budget is exceptional - $5.4 billion ($5.1 billion of which is from GR). Even though most of this money will be spent in FY2023-24, it is technically appropriated for FY2022-23, so it is not included in GAA total. This understates the amount actually appropriated during the session. This Budget Guide also does not include this spending in total appropriations for FY2023-24, but it does list each of these appropriations (see page 28-29). This includes the $4.0 billion Moving Florida Forward program which will accelerate transportation projects focused on relieving congestion.

Florida’s state budget has grown by 28.6 percent in the last three years, the largest three-year growth since the housing bubble and economic boom of FY2004-05 through FY2006-07. This does not include the spending of an additional $26 billion in federal pandemic-relief and state funds not included in appropriations totals.

The Governor and the Florida Legislature deserve credit for spending the money that has been available in a largely responsible manner. They were able to make significant investments in infrastructure, the environment, education, and teachers, while enacting record tax cuts and maintaining exceptional levels of reserves.

However, local member projects which generally have no statewide impact have also proliferated. The new budget contained a record level of member projects – more than 1,540 projects worth approximately $3.2 billion (before the vetoes).

The state is still in excellent fiscal health, but our budget surplus is dwindling. After accounting for all the spending in the General Appropriations Act and other substantive bills, the state is expected to have $5.3 billion in unobligated General Revenue (GR). While still an exceptional amount, the budget surplus is down from the $17.7 billion balance that was estimated to be remaining at the end of this fiscal year and the $22.8 billion the state had left over in FY 2021-22.

The growth in revenue the state has enjoyed will likely not continue. Economists are expecting growth to slow considerably in the near future. Florida must continue to be responsible with taxpayer money.

In addition to providing many facts and figures explaining this year’s budget and detailing the highlights, this guide also provides past budget data to put it in historical context. We hope this annual Budget Guide gives you the information you need to better understand where and how your hard-earned tax dollars are being spent.