A Rising Tide Sinks All Homes - The Effects of Climate Change on Florida's Economy

With more than 8,400 miles of coastline and a flat, low-lying coastal topography, Florida is especially vulnerable to the effects of sea level rise. Tens of thousands of Florida homes and businesses are at increased risk from sea level rise. Much of Florida’s critical infrastructure is at low elevations, designed and built with little consideration of future sea level rise.

The physical effect of changing climate translates into real economic impacts. The long-term economic impacts of climate change will be most severe on Florida’s attractiveness as a destination for retirees and seasonal visitors. In the short term, more frequent and severe weather events will have disruptive physical and fiscal consequences for many taxpayers. Florida’s favorable climate, attractive waterfronts, and tourist attractions have been the main draws, but increasing storm surges and hurricanes and rising insurance costs could change that. Florida’s economy and quality of life depend heavily on preserving and sustaining these valuable resources.

Vulnerability associated with Florida’s changing climate is not limited to coastal communities. Rising sea levels and more extreme storm surges make Florida’s freshwater underground aquifers vulnerable to saltwater intrusion. Higher evaporation rates contribute to more frequent and intense rainfall events, which make Florida vulnerable to inland and river flooding. Florida is also likely to experience severe health-related impacts resulting from rising temperatures (e.g., lost work time for heat-exposed workers, work-related injuries, and increased healthcare costs, etc.).

Accelerated rates of sea level rise will have profound effects on Florida’s coastal ecosystems and will add to Florida’s vulnerability to hurricane storm surge, which poses the greatest threat to lives and property. Sustained global warming will likely result in more frequent and intense hurricanes.

Florida’s climate is changing. Increasing levels of greenhouse gases in the atmosphere allow the atmosphere to retain more heat energy, which is accompanied by increases in ocean temperatures. As ocean temperatures increase, the great ice sheets melt, ocean water expands, and sea levels rise.

This comprehensive report is intended to help taxpayers and policymakers better understand the effects of climate change on each sector of Florida’s economy, and to recommend reasonable ways to mitigate those impacts. We greatly appreciate the insights provided by our many partners, which we have tried to capture and present in this report. We look forward to discussing our findings and recommendations with policymakers during the 2022 legislative session and beyond.

Sectors Include:

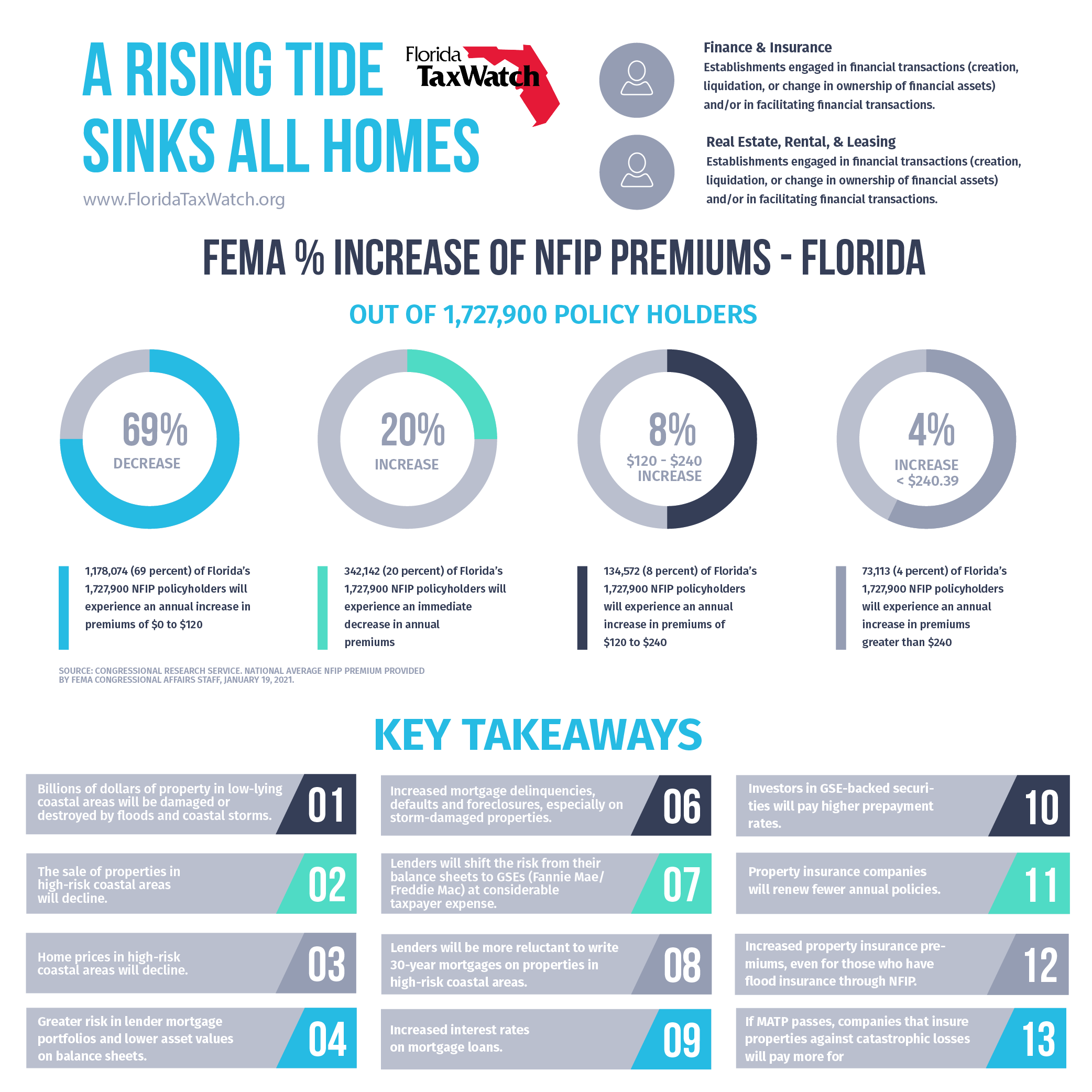

- Financial Activities

- Trade, Transportation, and Utilities

- Professional and Business Services

- Government

- Education and Health Services

- Leisure and Hospitality

- Manufacturing

- Information

- Construction

- Other Services

- Agriculture