Florida's FY2022-23 State Budget

Florida TaxWatch is pleased to present taxpayers with a guide to the FY2022-23 state budget, which went into effect July 1, 2022. The report includes all appropriations for the new fiscal year— the General Appropriations Act (GAA), “back-of-bill” spending, and general bills—net of the Governor’s vetoes.

With billions in federal aid coming to Florida during the pandemic, and state revenue collections well-above pre-COVID levels, the 2022 Legislature came into session with an historically high budget surplus. Including the $3.5 billion in federal fiscal recovery funds not yet spent, lawmakers had almost $54 billion in GR available for the new budget. As a comparison, the 2021 Legislature appropriated $36.5 billion in GR.

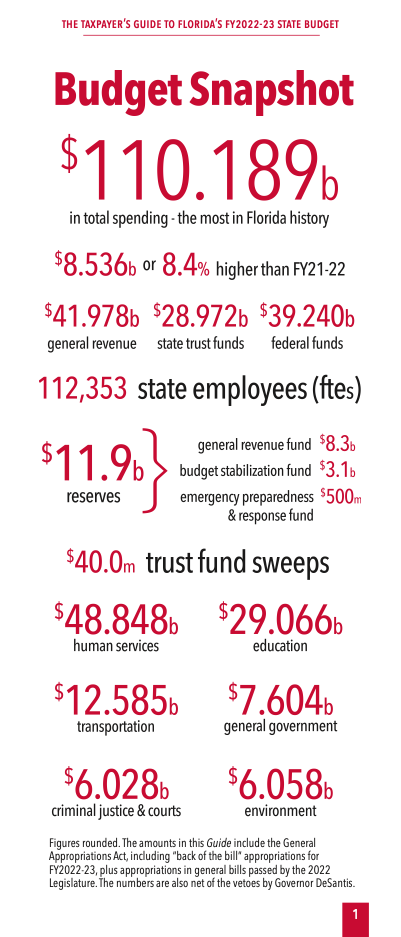

The 2022 Legislature passed a record $112.1 billion budget. After adjusting for other appropriations and vetoes, appropriations for FY2022-23 total $110.189 billion, an 8.4 percent increase over current spending. The state budget has grown by nearly 20 percent in two years. In addition, the GAA includes $3.5 billion in federal fiscal recovery funds and another $2.1 billion in federal and state funds in the “back-of-the-bill” which are not included in these totals (because they are technically appropriated for FY2021-22).

This increased revenue led the 2022 Legislature to invest in state employees with an across-the-board 5.4 percent pay raise (plus numerous other targeted pay enhancements) and provide substantial increases in per-student spending and education facilities, environmental, and health care spending. And, of course, legislators passed an unprecedented number of local projects to take back home. (See the Florida TaxWatch 2022 Budget Turkey Watch report).

Lawmakers also provided $1 billion in tax relief, most of it going to individual taxpayers, with relatively little targeted at businesses. Even with all these spending initiatives, the state still has record General Revenue (GR) reserves of $11.9 billion (a number that is sure to grow considerably when the next revenue estimates are adopted in August).

These reserves were boosted by the Governor’s $3 billion in line-item vetoes. While not all these vetoes reduced the size of the budget, they did cut FY2022-23 spending by $2.1 billion ($1.9 billion in GR). In addition to many facts and figures explaining this year’s budget, this guide also provides past data to put it in historical context. We hope this annual budget pocket guide gives you the information you need to better understand where and how your hard-earned tax dollars are being spent.