Session Summary: 2024 Taxpayer Roundup

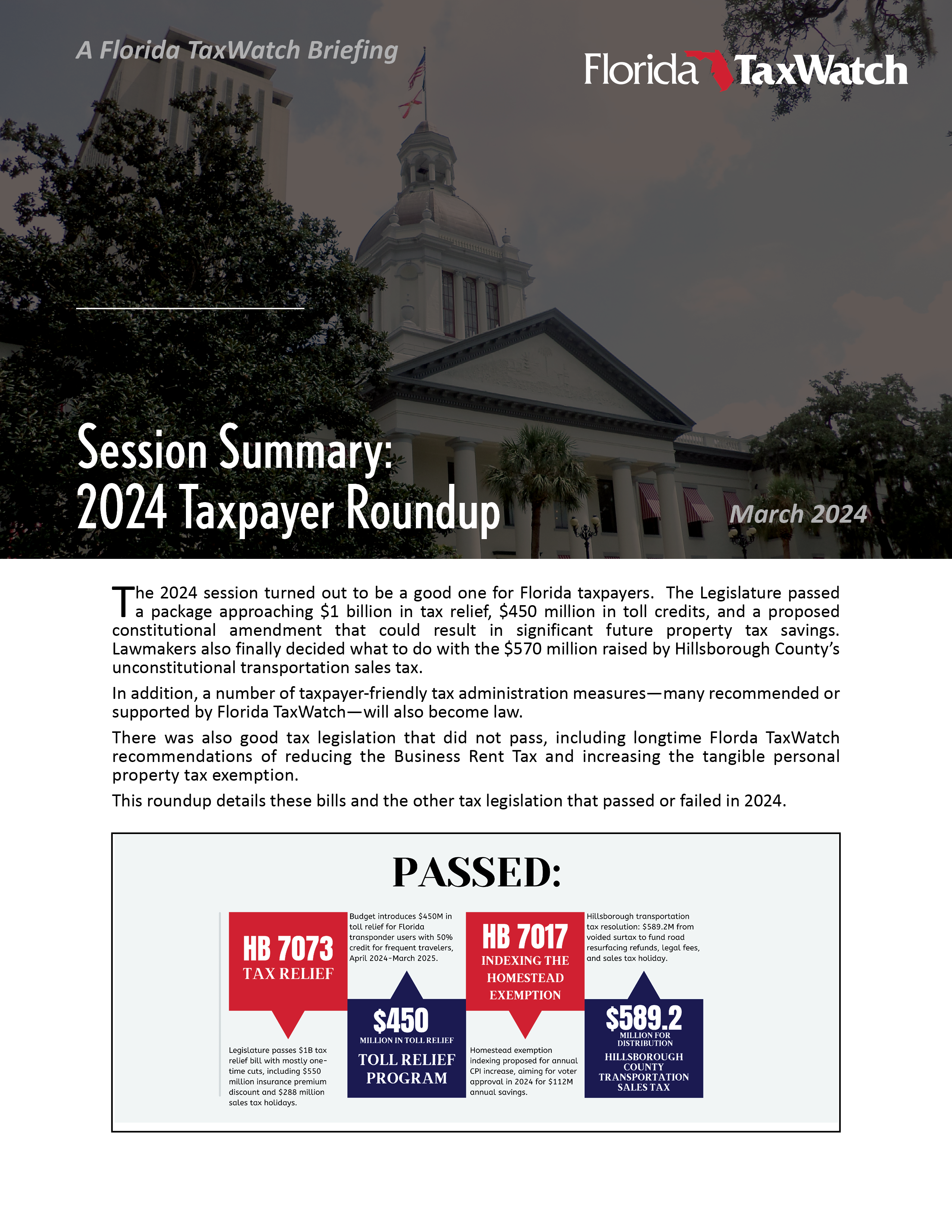

The 2024 Florida Legislative Session's Taxpayer Roundup report highlights significant legislative achievements in tax legislation, emphasizing tax relief and administration measures that benefit Florida taxpayers. With a total package approaching $1 billion, including $450 million in toll credits and a proposed constitutional amendment for property tax savings, the session marked a notable success for fiscal reforms. Key achievements include extensive tax relief measures, such as a one-year exemption in property insurance taxes, sales tax holidays, and new tax credits for employing individuals with unique abilities and providing child care for employees. Moreover, the session addressed the disposition of funds from Hillsborough County's unconstitutional transportation sales tax, allocating them towards road resurfacing, legal fees, and a local sales tax holiday.

The 2024 Florida Legislative Session's Taxpayer Roundup report highlights significant legislative achievements in tax legislation, emphasizing tax relief and administration measures that benefit Florida taxpayers. With a total package approaching $1 billion, including $450 million in toll credits and a proposed constitutional amendment for property tax savings, the session marked a notable success for fiscal reforms. Key achievements include extensive tax relief measures, such as a one-year exemption in property insurance taxes, sales tax holidays, and new tax credits for employing individuals with unique abilities and providing child care for employees. Moreover, the session addressed the disposition of funds from Hillsborough County's unconstitutional transportation sales tax, allocating them towards road resurfacing, legal fees, and a local sales tax holiday.

The report details both passed and failed tax legislation, highlighting Florida TaxWatch's role in advocating for taxpayer-friendly measures. Notably, the session saw the failure to pass reductions in the Business Rent Tax and the increase in the tangible personal property tax exemption, both long-standing recommendations of Florida TaxWatch. The document also includes comprehensive descriptions of the final tax package provisions, ranging from insurance premium discounts to various tax credits and exemptions aimed at supporting families, businesses, and specific industries.

Florida TaxWatch advocates for efficient tax administration and supports legislative efforts that ease the tax burden on Florida's citizens and businesses. The report serves as a detailed account of the 2024 session's tax-related outcomes, offering valuable insights for policymakers, taxpayers, and anyone interested in the state's fiscal health and governance. It underscores the organization's commitment to monitoring tax legislation and advocating for policies that promote economic growth and fairness in tax administration.