Florida TaxWatch Analyzes the Trends of Supply and Demand in Florida’s Housing Market

FOR IMMEDIATE RELEASE: Thurs., March 16, 2023

CONTACT: Aly Coleman Raschid, aly@on3pr.com, 850.391.5040

Florida TaxWatch Analyzes the Trends of Supply and Demand in Florida’s Housing Market

Tallahassee, Fla. – Today, Florida TaxWatch (FTW) released Florida’s Housing Market: Trends of Supply and Demand. This commentary analyzes the increasing cost of buying a house due to supply and demand issues in Florida, building upon FTW’s January 2023 report, Economic Commentary: An Update on Florida’s Housing Rental Market, which evaluated Florida’s challenges with the ever-rising cost of rent. In this report, the taxpayer research institute examines the slowly developing supply of housing units, the growing and evolving demand for housing stock, and the consequences of the high housing and rental prices.

Florida TaxWatch President and CEO Dominic M. Calabro said, “Florida continues to grow, and it is vital for infrastructure to keep pace to ensure that the needs of families, workers, and retirees in our communities are met. With the state’s increasing popularity – it’s now widely known as the best place to live, work, and realize your dreams – the demand for homes has also increased, and when coupled with the rapid rise of inflation, we find housing costs have soared, with expenses expected to continue climbing over time. The notable surge in rental leases and housing purchases, as well as the very obvious limits in available housing stock, are all tell-tale signs of a stressed housing market.

“Florida TaxWatch recommends Florida’s legislative leaders focus on promoting the development of multi-family units with rent that would be attainable for working Floridians, and single-family units that would be affordable to first-time homebuyers and retirees. However, the state does not just need a one-time influx of housing units, but rather, policies that encourage continual development of housing units as the population continues to grow.

“Floridians may soon see modifications to the state’s housing policies this session, including Senate Bill 102, which would provide incentives for property development, expand ad valorem property tax exemptions, and add funding to a number of housing programs. This is a step in the right direction, helping families realize the American Dream of having a good home.”

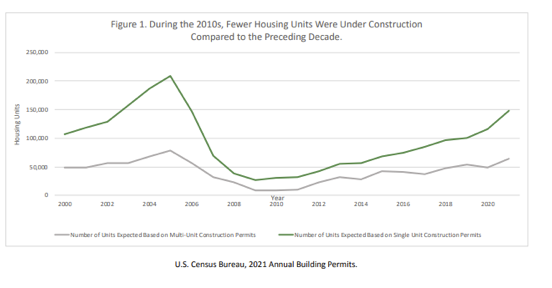

FTW notes that during the 2010s, construction of housing units was significantly lower than previous decades, mainly due to consequences from the early 2000s housing boom, the Great Recession of 2008, and the COVID-19 pandemic. Within the past few years, construction of housing units has begun to make a comeback in Florida. In 2021, a total of 213,500 housing units were authorized for construction, a 30.1 percent increase from the prior year. This number is high, second only to Texas, but the number is still less than the peak construction witnessed in 2005.

According to FTW, the growing demand for types of housing is not equally spread among all the available housing stock, causing a small portion of Florida’s housing supply to carry the brunt of demand. Historically, emerging generations entered the housing market with the purchase of “starter homes,” but whether due to limited inventory or changing preferences, these houses are no longer the common purchase among first-time homebuyers. Rather, the first-time buying Millennials (ages 27 to 42) and the repeat-buying Baby Boomers (ages 59 to 74) often find themselves looking for similarly sized homes in the same locations. This competitive housing market causes some would-be-homebuyers to remain renters.

FTW asserts that fast growing prices make it increasingly difficult for lower-earning households to secure housing, leaving them susceptible to becoming cost burdened. To alleviate the cost burden of Florida’s lowest earners alone – those earning below 30 percent of average median income – the state needs an additional 323,219 available units.

As Florida’s population continues to age and demand different types of homes, while at the same time the state continues to attract young professionals and families, it will become even more crucial to ensure availability of attainable housing at all levels in order to meet Florida’s future demand. The challenge of limited workforce housing options especially hurts Florida’s ability to attract and retain young professionals. According to one index cited by FTW, the median income of Florida’s experienced employees ($65,312) exceeds the state’s average median household income ($61,777), but the same is not true for the median income of entry-level employees ($25,210). Due to the unstable housing market, some young professionals may choose to live with their parents or roommates, or they may be inclined to find a job in a different community or state to attain the living arrangements they prefer.

For more information and to access the full report, please click here.

About Florida TaxWatch

As an independent, nonpartisan, nonprofit government watchdog and taxpayer research institute for more than forty years and the trusted eyes and ears of Florida taxpayers, Florida TaxWatch works to improve the productivity and accountability of Florida government. Its research recommends productivity enhancements and explains the statewide impact of fiscal and economic policies and practices on citizens and businesses. Florida TaxWatch is supported by its membership via voluntary, tax-deductible donations and private grants. Donations provide a solid, lasting foundation that has enabled Florida TaxWatch to bring about a more effective, responsive government that is more accountable to, and productive for, the citizens it serves since 1979. For more information, please visit www.floridataxwatch.org.

###