Florida TaxWatch Releases Report Analyzing Significant Rise in Prices in Florida’s Rental Market

Tallahassee, Fla. – Today, Florida TaxWatch (FTW) is releasing an economic commentary entitled Too Expensive to Rent: Florida’s Rental Market and Eviction Moratorium. The report analyzes the accelerated demand for rental properties in Florida and the significant rise in prices since the onset of the COVID-19 pandemic. It presents concerns relating to such rapid rent growth, focusing on the impact of a lack of affordable workforce housing, while also considering the prevalence of evictions throughout the state now that the federal eviction moratorium has expired.

Florida TaxWatch President and CEO Dominic M. Calabro said, “Our grocery bills are rising at an unprecedented rate, and other everyday costs, like gasoline, have soared recently. These escalating prices have also pervaded the housing market, and as a result, young professionals and growing families who may have considered homebuying before the pandemic can’t afford it now, leaving them with renting as their only viable option.

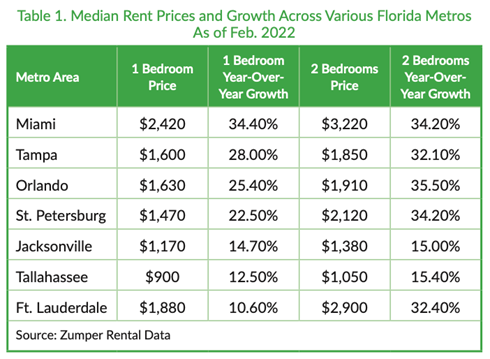

“In turn, excessive pressure has been placed on Florida’s rental market, causing those prices to climb from a median of $1,340 in February 2020 to over $1,760 in February 2022. Compounded by mass workforce migration from other states, a few larger cities, such as Miami, Tampa, and Orlando, have outpaced other metropolitan areas across the country, including New York City.

“While Florida is known for its robust job creation and low-tax environment, affordable housing is understandably a major concern for many, and it threatens to undermine the state’s continued economic recovery and ultimate success. Leaders and decisionmakers should heed this warning and adapt as appropriate to ensure all who call – and hope to call – the Sunshine State ‘home’ can thrive here.”

Explored in a previous FTW commentary, Beyond the Pandemic: Long-Term Changes and Challenges for Housing in Florida, housing prices spiked considerably throughout 2021, effectively pricing out many would-be first-time homebuyers, particularly growing families. As of the fourth quarter in 2021, the rental vacancy rate was 5.9 percent in the nation’s southern region (Florida included) – the lowest ever on record.

Rental prices began rising in Florida in spring of 2021, before rapidly accelerating that summer. Although a seasonal cooldown leveled out rent growth toward the end of 2021, it will likely resume its upward trajectory over the coming months. At a national level, preliminary forecasts suggest a steady growth of 7.1 percent throughout 2022, somewhat higher than home price growth.

In Florida’s urban areas, rent prices will likely exceed national estimates, and specific neighborhoods may maintain the double-digit growth rates that have been reported since 2020, with some exceeding 60 percent.

FTW notes that without affordable, feasible housing options, rental property shortages could persist. Constrained household budgets may be another implication, even as wages rise, in addition to service industry sectors losing younger, often lower-income workers. Difficulties with acquiring talent may lead to many young professionals moving away from Florida.

Meanwhile, Princeton University’s Eviction Lab found that weekly filings for evictions have oscillated between 220 and 380 in Tampa since the federal moratorium ended in August 2021, yet that is not substantially higher than it was during the moratorium. Still, initial data indicates evictions may be escalating, with a 30 percent increase from historical averages reported in Jacksonville and Gainesville in March 2022.

For more information and to access the full report, please click here.