Florida TaxWatch Forecasts Florida’s Economy Through 2028

Tallahassee, Fla. – Today, Florida TaxWatch released Florida Economic Forecast (2023-2028). In this report – the first in a new quarterly series – the taxpayer research institute assesses various data, including population and net migration, employment, gross domestic product (GDP) and income growth, and tourism, to provide a forecast of Florida’s economy through 2028. The data upon which these forecasts are based is provided through a partnership with the Regional Economic Consulting Group (“REC Group”), a research-based consulting firm that provides economic studies to help guide and inform business leaders and policymakers.

Florida TaxWatch President and CEO Dominic M. Calabro said, “Currently, Florida’s economic growth continues to outpace other states across the nation, and we also boast the 14th largest economy in the world. This formidable status can certainly be attributed, in no small part, to our state leaders’ conservative fiscal policies and strategic response to the COVID-19 pandemic, but the question remains: Is it sustainable over the next several years? Florida TaxWatch is proud to offer this report to help answer that question, inform additional research, and plan for the Sunshine State’s bright future.”

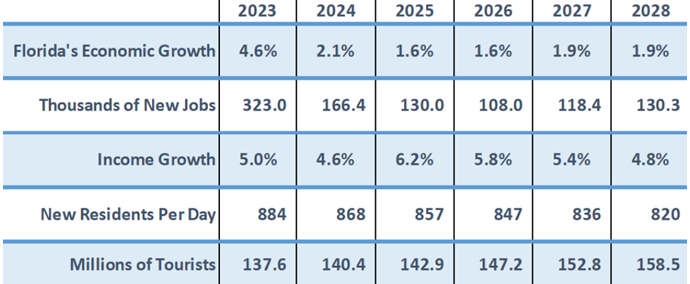

According to Florida TaxWatch, Florida’s population is projected to increase by approximately 1.45 million people from 2023 to 2028 (from 22.7 million to 24.1 million). However, net migration, or the number of people moving to the state every day, is expected to decrease from 884 in 2023 to 820 in 2028. This reflects a shift in the balance between people moving into Florida and people moving out of the state, with more people predicted to move into the state, but at a slower (decreasing) rate. Those leaving the state cite concerns such as increased costs of living, rising property taxes, rising property and automobile insurance, rising housing costs, worsening traffic, and more frequent and severe weather events.

In terms of employment, Florida TaxWatch indicates the number of Floridians with a job is projected to increase from 9.8 million in 2023 to 10.4 million in 2028, while the state’s unemployment rate is projected to increase from 2.8 percent in 2023 to 4.3 percent in 2026 and ultimately decrease to 4.2 percent in 2028.

The difference between the growth rate of Florida’s GDP (raw) and real GDP (adjusted for inflation), meanwhile, is becoming smaller – from 5.2 percent in 2023 to a projected 2.2 percent in 2028 – which Florida TaxWatch suggests means the rate of inflation is expected to decrease in the coming years. Additionally, the growth rate in per capita income was five percent in 2023, but it is predicted to increase to 6.2 percent in 2026 and then decrease to 4.8 percent by 2028. That is an annual average growth rate of 5.9 percent, signifying Floridians’ spending capabilities will be on the rise.

Regarding tourism, which directly supports 1.3 million jobs and is responsible for $73 billion in employee wages throughout Florida, Florida TaxWatch notes the industry will maintain its strong growth and the number of visitors is projected to continue increasing year-over-year through 2028.

Altogether, Florida TaxWatch projects that Florida's economy will continue to grow, but at a slower rate through 2026, and then begin to return to more characteristic measures as businesses and consumers transition from a "high inflation" environment to a "high interest rate" environment.

Source: REC Group

To learn more and access the full report, please click here.

About Florida TaxWatch

As an independent, nonpartisan, nonprofit government watchdog and taxpayer research institute, and the trusted “eyes and ears” of Florida taxpayers for more than 45 years, Florida TaxWatch (FTW) works to improve the productivity and accountability of Florida government. Its research recommends productivity enhancements and explains the statewide impact of fiscal and economic policies and practices on taxpayers and businesses. FTW is supported by its membership via voluntary, tax-deductible donations and private grants. Donations provide a solid, lasting foundation that has enabled FTW to bring about a more effective, responsive government that is more accountable to, and productive for, the taxpayers it serves since 1979. For more information, please visit www.floridataxwatch.org.