INTERNATIONAL TRADE AS A CATALYST FOR FLORIDA’S ECONOMY

Critical for Florida’s continued innovation, growth, and diversification, international trade must be a key priority in the dynamic post-pandemic economy. Despite facing significant headwinds in recent years, Florida will continue to serve as a global trading hub, leveraging its multimodal transportation network, advanced manufacturing capabilities, and unparalleled access to markets in Latin America and the Caribbean. Yet the combination of localized lockdowns, supply chain disruptions, and geopolitical conflicts around the world speak to ongoing uncertainties and underscore an urgency for adequate resiliency. Florida can take proactive steps to improve resiliency against unforeseen disruptions while also catalyzing future economic prosperity through international trade.

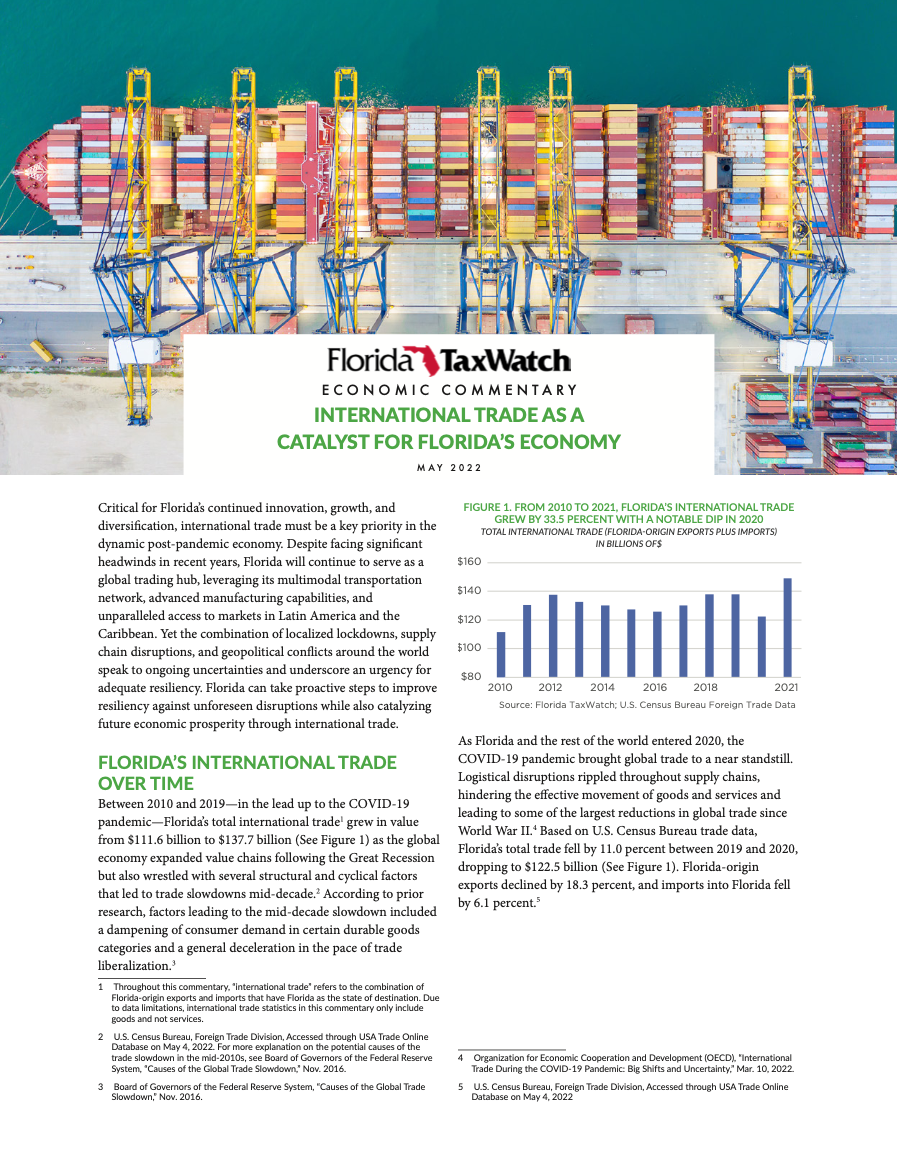

Between 2010 and 2019—in the lead up to the COVID-19 pandemic—Florida’s total international trade grew in value from $111.6 billion to $137.7 billion (See Figure 1) as the global economy expanded value chains following the Great Recession but also wrestled with several structural and cyclical factors that led to trade slowdowns mid-decade. As Florida and the rest of the world entered 2020, the COVID-19 pandemic brought global trade to a near standstill. Despite the considerable decline, trade came roaring back in 2021—a testament to Florida’s “open for business” strategy and a general easing in some pandemic pressures. By the end of 2021, total trade eclipsed $149.1 billion (higher than pre-pandemic levels), and Florida-based exports reached $55.5 billion. For comparison, pre-pandemic Florida-based exports were $55.9 billion in 2019.

Looking ahead to the remainder of 2022, Florida’s monthly exports appear poised to steadily grow. Based on Florida TaxWatch forecasts, monthly exports are anticipated to average $5.6 billion through the rest of 2022 (See Figure 2). For Florida to continue capturing the economic benefits that accrue from international trade, the state must pursue several strategies, including but not limited to: manufacturing more in the state; improving supply chain resiliency through tools like Connex Florida; boosting Florida-origin exports; and expanding trade opportunities with international partners in Latin America, the Caribbean, and emerging markets.

Entering 2022, global trade was forecasted to rise by 4.7 percent year-over-year; however, due to geopolitical tensions in eastern Europe and escalating commodity prices, the World Trade Organization (WTO) lowered growth predictions to 3.0 percent. Despite the downside risk in parts of the world, international trade opportunities for Florida are forecasted to rise throughout the year, reflecting the advantages of an “open-for-work” strategy, strengthening the manufacturing sector, and burgeoning consumer demand. For Florida’s long-term future, taking proactive steps to invest in the state’s manufacturing sector, supply chain resiliency, export capacity, and trade opportunities with partners in Latin America and the Caribbean are among some of the various strategies that will generate benefits for Florida businesses and families.