2021 Taxpayers Guide to the FY2021-22 Florida State Budget

Florida TaxWatch is pleased to present taxpayers with a guide to the FY2021-22 state budget, which went into effect July 1, 2021.

The FY2021-22 Florida budget process was like no other. It began with lawmakers wondering where the money was going to come from to fund basic services and ended with them wondering how to spend all the money. Last year’s budget was passed just as COVID-19 was hitting Florida and the revenue impacts were immediate and severe. Projections that lawmakers would be facing a General Revenue shortfall of up to $3 billion this session were made and exercises to identify potential budget cuts began.

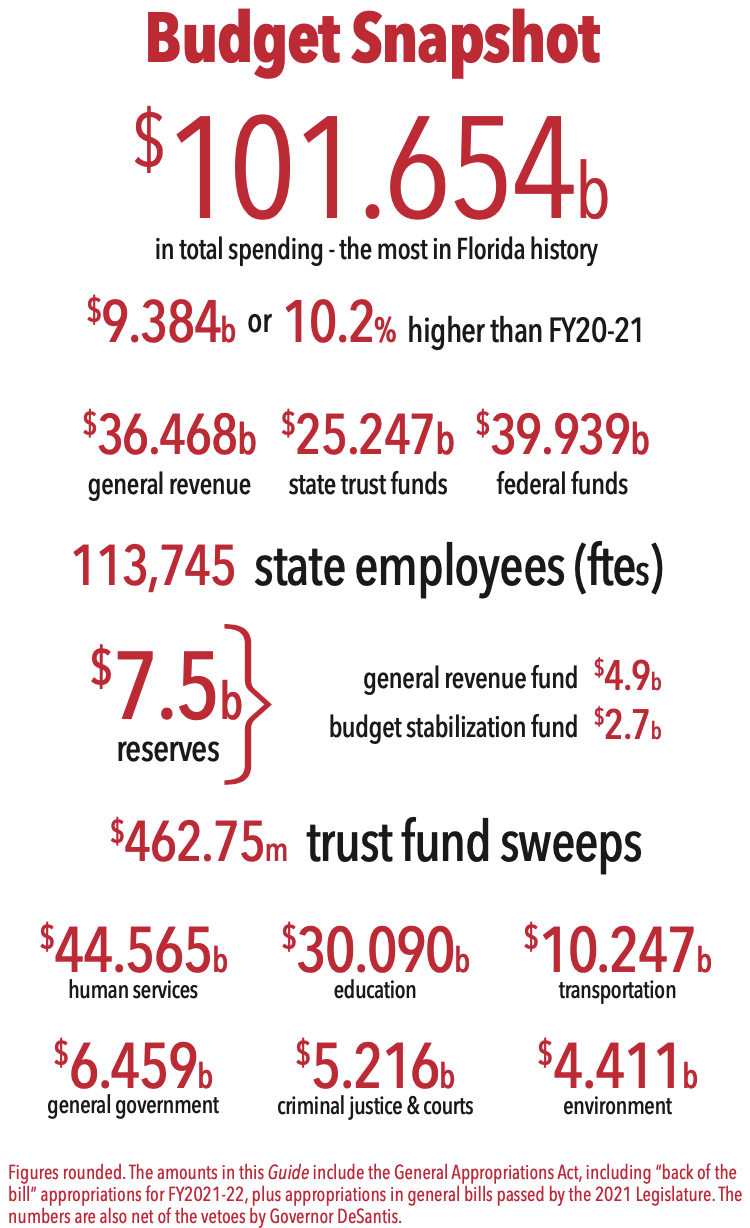

Thankfully, $5.8 billion in federal funds from the CARES Act helped the state avoid a deficit in FY2019-20 and FY202-21. Then the economy began recovering much quicker than anticipated and another massive influx of federal aid allowed the 2021 Legislature to pass the largest budget in history, leave a record amount of reserves, and even provide some tax relief. Most of the proposed cuts, including deep ones in health care, were scrapped, and big investments were made in many areas. The FY 2021-22 state budget totals $101.7 billion. Most new state budgets are record in size, but this new budget is $9.4 billion (10.2 percent) more than the current one, the largest percentage growth in 15 years. This increase over current spending includes $6.9 billion in increased federal Medicaid and education funds.

Even more remarkable, the budget also appropriates an additional $15.4 billion in federal funds

in the “back of the bill” from the American Rescue Plan and other sources. Since this money was technically appropriated for FY2020-21, although at least most of it will be spent in FY2021-22, it is not counted in the budget totals. If it were counted, the new budget would be a $25 billion increase over current spending.

Part of this additional federal funding is $5.3 billion of the $8.8 billion in federal stimulus aid the state is expected to receive from the Coronavirus State Fiscal Recovery Fund (CSFRF) in the American Rescue Plan. The Legislature did outline how these funds will be spent, and significant investments are being made, especially in environmental programs, transportation, and public facilities. Florida TaxWatch commends the Legislature for not immediately spending all the (CSFRF) money. The remaining dollars will go into General Revenue reserves.

In addition to many facts and figures explaining this year’s budget, this guide also provides past data to put it in historical context. We hope this annual budget pocket guide gives you the information you need to better understand where and how your hard-earned tax dollars are being spent.